Crystal Ball Perspectives

10 Key Trends Expanding Decentralized Ecosystem’s Frontiers in 2024

Introduction

Is this the end of crypto winter, or are we still being cautious, and our optimism returns after a tumultuous 2022 and 2023? It’s time to set our sights on the road ahead. While broader market indicators suggest stabilization, if not yet full-fledged recovery, the incredible building continues below the surface.

A watershed development cementing Bitcoin's institutional adoption was the U.S. SEC approval of Bitcoin spot ETFs on January 11th, 2024. This milestone saw 11 ETFs tracking Bitcoin's market price get regulatory greenlight. The move promises to funnel significant capital into Bitcoin from investors preferring regulated vehicles. Estimates suggest over $100 billion could enter Bitcoin markets in the next year through ETFs. The attendant publicity also promises to alter Bitcoin's cultural perception while redefining market dynamics.

ETFs represent the pinnacle of Bitcoin's integration with mainstream finance. Institutions can now offer customers broad access conveniently via traditional wrappers. Better visibility and liquidity beckon. Legacy giants’ aggressive marketing exposure will remove the stigma for customary investors. With the floodgates open, ETFs will likely dominate Bitcoin's narrative over 2024. Inflows stretching into the hundreds of billions would propel new all-time highs. Regulated on-ramps portend further convergence between TradFi and crypto.

Mirroring Bitcoin's watershed spot ETF moment, Ethereum is poised for a similar milestone with spot ETF approvals expected by May 2024. As the second largest cryptocurrency with a thriving Web3 economy, an Ethereum ETF opens the floodgates for billions in inflows from institutional capital seeking regulated exposure.

An SEC approved Ethereum ETF further cements the asset class' credibility in traditional finance circles. The attendant publicity promises to draw mainstream attention to Ethereum's technological leadership with transformations like proof-of-stake merging and scalability solutions catalyzing adoption.

With bluechip institutions scrambling to launch Bitcoin ETFs, allowing an Ethereum counterpart taps into intense competition around crypto offerings. The brand halo for DeFi and NFT ecosystem viability could significantly expand Ethereum's total addressable market and, subsequently, retail and institutional exposure to both ETH and BTC.

As we look towards 2024 and beyond, what are the key trends that will reshape architecture and applications dictating mainstream traction? This forward-looking analysis identifies eleven fundamental trajectories set to redefine blockchain’s evolution through 2024 based on today’s leading indicators:

Trend 1: Restaking & Shared Security. Rollup restaking allows staked ETH validators to reuse assets for securing supplemental protocols. This amplifies staker yields while improving scalability and composability for chains. As blockchains interconnect via bridges and shared environments, understanding security tradeoffs becomes critical. Prospects appear bright for Actively Validated Services powering modular rollup stacks in 2024.

Trend 2: Data Availability. Ethereum's base layer upgrade "danksharding" will standardize data availability for rollups in 2023. This unlocks major cost savings that decisively boost rollup capabilities by resolving scalability bottlenecks.

Trend 3: DEXs & Perpetuals. Decentralized exchanges are gaining share against centralized alternatives, with models like automated market makers and order book pools demonstrating incredible promise within fast-growing perpetual swaps markets.

Trend 4: All things Zero-Knowledge (ZK). ZK rollups are gaining traction by resolving EVM compatibility issues. Also exponential growth expected in ZKML and ZK coprocessors to unlock new functionality realms for dApps constrained by blockchain limitations.

Trend 5: Decentralized Physical Infrastructure (DePIN). Blockchains coordinating real-world infrastructure like networks and storage, efficiently displacing legacy providers via crypto-economic incentives and community alignment.

Trend 6: Real World Assets (RWAs). Tokenization of assets like real estate and invoices on blockchains bridges traditional finance, unlocking efficiency and transparency improvements.

Trend 7: Stablecoins. Despite moderate growth, stablecoins remain deeply embedded in on-chain workflows enabling vital functions like cross-chain liquidity movement and hedging volatility.

Trend 8: Intents. Middleware protocols decoding user intents and executing optimized transaction pathways to fulfill goals automatically, abstracting complexity.

Trend 9: Bitcoin. Ordinal inscriptions like BRC-20 are transforming Bitcoin's utility and transaction mix, while price resilience returned in 2023.

Trend 10: Solana. Exceptional price and volume growth in 2023 validates Solana’s real-world capacity and ability to unlock unprecedented on-chain throughput and scalability.

Let’s dive deep.

Trend #1: Restaking and Shared Security:

Restaking refers to the concept of reusing or "re-staking" the collateral that validators have locked up in Ethereum to provide additional security guarantees or utility in other blockchain protocols or applications.

Restaking lets staked ETH that already secures Ethereum's base layer get reused to provide security for extra on-chain services.

· Validators: Lock 32 ETH to stake on Ethereum. Restaking platforms like EigenLayer allow reuse of this collateral to secure other blockchains. EigenLayer restakes the ETH to validate transactions elsewhere. As compensation, validators get paid in that chain's token yield on their staked ETH. But they take on more slashing risk across multiple chains.

· Users: Can stake ETH to validate Ethereum and earn rewards. Restaking directs the same staked ETH to also secure Ethereum layer 2 solutions. This "re-promises" the ETH to be slashed if validation of additional protocols fails. By reusing staked deposits, restaking maximizes capital efficiency to secure multiple solutions from the same ETH pools.

The Staking and Restaking ecosystem has grown exponentially this year.

With this increased engagement and adoption, one key area we are excited to look into is the Restaked Rollups framework which was recently announced by EigenLayer and AltLayer.

Rollups have exploded in 2022-23, securing over $16B in assets. But smaller rollups often have centralized infrastructure, harming decentralization. Restaked rollups offer a path to resolve centralization and performance issues in Ethereum scaling solutions. By outsourcing key components like sequencing and validation to decentralized services powered by reused collateral, they promise better decentralization without sacrificing speed. They introduce:

SQUAD - Decentralized sequencers to order transactions

VITAL - Decentralized validators to verify computation

MACH - Faster finality of results before Ethereum settlement

If viable, this model could greatly accelerate rollup adoption and Ethereum scaling.

We foresee Actively Validated Services (AVS) powering modular rollups as a key 2024 trend based on:

AVS aligns with Ethereum's roadmap as rollups mature atop data availability systems. Reusable components match direction.

Crypto-economic primitives like programmable staking/restaking and pooled security will gain traction as tools to coordinate AVS.

Formalized ETH staking will enable leveraging collateral for decentralized rollup functions as it professionalizes.

It is also important to note that Restaking is not only limited to EigenLayer.

Polygon will enable POL stakers to earn extra rewards by redirecting staking to secure multiple L2 chains in Polygon ecosystem, not just Polygon's base layer.

This resembles restaking by allowing staked assets to provide security to supplemental protocols beyond initial staking purpose.

Cosmos' Interchain Security

Cosmos' interchain security model allows ATOM stakers to reuse staking to consensus-secure other blockchain networks beyond Cosmos Hub like Neutron and Stride leveraging shared security.

This provides analog to restaking where validators can permissionlessly extend staking assets to power additional chains while keeping staking consolidated.

EigenLayer recently announced strategic bridging of Ethereum and Cosmos, enabling mutual access to each other's security, liquidity, innovations, users, and node operators to amplify capabilities across both ecosystems. Now, that’s two of L2IV portfolio companies that provide shared security solutions to Cosmos: Babylon and now EigenLayer.

Octopus Network for Near Protocol

Octopus Network allows NEAR token stakers to lease their staking to secure application-specific chains like Ottochain via leased proof-of-stake model.

The fact that restaking is gaining broader traction even on chains like Near Protocol validates that the premise of amplifying staked assets for higher utility resonates. With this adoption outside of Ethereum, we will end up seeing different permutations like

leased security (Allowing stakers on one chain to lease their assets to secure other chains),

liquidity provider token staking (Staking LP tokens from AMMs to help secure protocol and earn additional yield),

guest blockchains bound to bridges (Standalone chains with security dependencies bound to a parent chain via bridges), etc.,

suggesting many creative configurations are possible by applying restaking.

The common driver seems to be allowing ecosystems to scale by tapping base-layer assurances to extend trust into emergent domains like app-specific chains, which expands into the concept of Shared Security.

This concept of 'shared security' refers to whether the security of assets on supplemental chains is ultimately dependent on and as robust as the security of the primary chain.

Rollups explicitly use Ethereum’s on-chain security because they are built on top of it while,

Platforms such as EigenLayer (with AVS) and Babylon (with staked BTC) enable permissionlessly 'sharing' the innate protections of base chains like Ethereum and Bitcoin by allowing staked BTC/ETH validators to reuse and redirect their collateral for securing those secondary environments like Cosmos.

These architectures effectively maximize flexibility while ensuring integrity by leveraging decentralized assurances developed by anchor settlements.

The core question is –

if assets or logic are moved from a highly secure "source" blockchain to an interconnected chain or ecosystem (for example, Cosmos) for on-chain validation, do they retain the same strong security model, or is security weakened?

Shared security aims to analyze these types of connections between chains and assess whether

security is tightly shared and dependent on the primary chain

"yes" for rollups via fraud/validity proofs,

"no" for independent sidechains

or

weakened through bridging across chains with now semi-independent security domains.

We believe Shared Security will become increasingly important as blockchain networks grow more interconnected through bridges, sidechains, rollups, etc., and ultimately through restaking platforms.

Another area we are brainstorming about is reassessing where the "source of truth" lies in an interconnected system of chains, which we believe will be an evolving discussion. Specifically, Is it the main L1 at all costs?

Chains without shared security may still derive value by providing use cases unsuitable for L1s and rollups like regulatory compliance, experimentation with new tech, customization, and more. The path to mass adoption likely involves both

pushing activity into shared security environments like rollups or the ones that use other L1s while also

improving bridges, sidechains to minimize threats for maximizing on-chain activity.

There is room for both strategies based on use case nuances.

We also assess that the primary mechanism for shared security will be validity proofs (main component of ZK rollups). Validity proofs align well with the crypto-economic priorities of blockchains around verifying state integrity without reproducing all computations. They elegantly bridge consensus layers’ validation logic to ecosystems needing it.

If the interconnected chain supports validity proofs, it enables highly robust shared security with the source. Examples include rollups connected to Ethereum through fraud proofs, plasma chains with commitments published to root chains, some sidechain arrangements, etc.

But they come with drawbacks like requiring extra data availability, complex fraud proof mechanics, and some centralization around operators batching transactions. Tradeoffs exist.

However, in the long run, we expect solutions to mitigate these issues considerably. For example,

mass validity proof generation at client level,

UTXO commitments for data availability (a good case study for this Babylon with Bitcon),

universal fraud proofs, and so on.

These could theoretically enable sharing not just asset security, but also bandwidth, storage and computing between chains/rollups. However, questions persist if validation logic remains anchored on public base layers without mechanical verification cultures. Settlement finality may necessitate an immutable "ground truth".

Open Question: Are the L1 chain always the security source of truth?

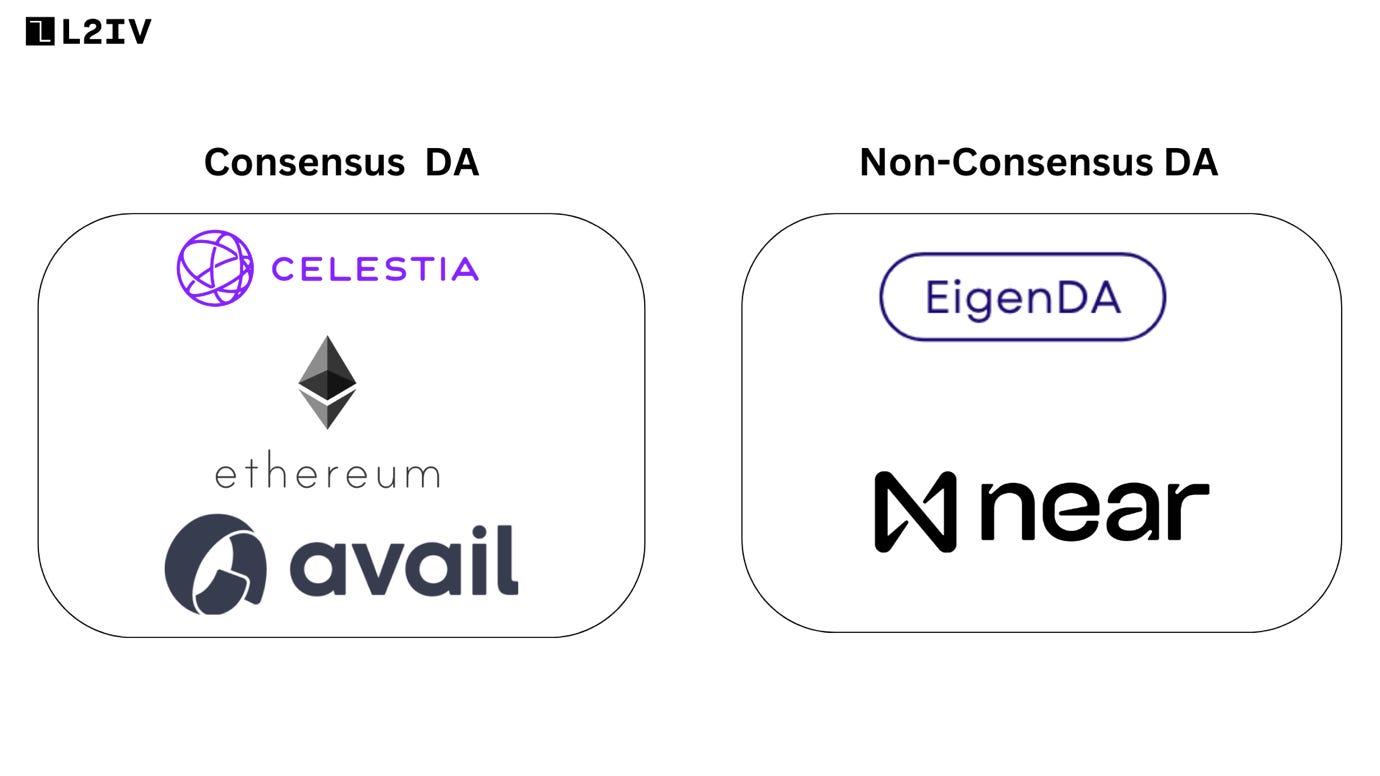

Trend #2: Data Availability (DA)

In case you don’t know what DA is, here’s a short blurb:

Data availability refers to the ability of nodes in a decentralized blockchain network to easily access the complete and truthful record of transactions or state changes that have occurred on the network.

In blockchains like Ethereum, transactions get grouped into blocks which represent the latest state of the ledger. For the network to function securely, the full details of every block need to propagated to all nodes so they can validate state transitions.

However, sometimes block producers may intentionally or accidentally withhold or limit access to some of the data in a published block. This constitutes a failure of "data availability".

Lack of availability means nodes no longer have an accurate record of network state on which to evaluate future transactions. They cannot independently verify the integrity and correctness of state changes, severely compromising trust and security.

This is why data availability is critical - all nodes must receive the complete details of all blocks and transactions in a timely manner to achieve decentralization and censorship resistance. The full truthful dataset must be readily accessible to any node that wishes to validate the chain's state.

We also wrote a detailed three-part series on Data Availability, which you can read here: Part 1, Part 2, and Part 3.

We believe Data Availability will be a pivotal trend in the coming year due to the confluence of several key factors:

Rollup adoption is accelerating as the preferred layer 2 scaling approach for Ethereum, with rising transaction volumes and total value locked. Ensuring efficient and decentralized data availability becomes increasingly critical to avoid bottlenecks or security risks as adoption grows.

Innovations in data availability schemes are gaining momentum, including advances in erasure coding, polynomial commitments, and availability sampling techniques. These provide the cryptographic constructions for scalable and lightweight data availability perfect for fast-moving rollups processing thousands of transactions per second.

Economic incentives around data availability are improving, including staking pools and protocols focused on decentralizing storage and rewarding availability providers. This supplements the technology with appropriate crypto-economic mechanisms.

Changes at the base layer, like proto-danksharding, will provide standardized data availability and fraud-proof interfaces between Ethereum and rollups. This will allow seamless interoperability between DA schemes and Ethereum.

As far as trends go in with DA and scaling Ethereum, as DA emerges as a crucial blockchain infrastructure sector, we face an important strategic choice:

Should DA primarily be viewed as a commodity capability, with providers competing mainly on driving down costs for availability services and racing to achieve the best economies of scale?

OR

Could there be lasting advantages for DA providers that actively differentiate by prioritizing community alignment rather than pure cost and capacity factors? Things like cultivating brand loyalty among developers, supporting specialized use cases, and bonding through shared values versus just transactions.

Put another way:

Will the market evolve towards a few mammoth DA layers competing on the lowest price to serve the majority of rollup needs?

OR

Can smaller, niche DA layers catering to specific aligned needs & use cases also thrive long-term alongside commoditized mass market offerings?

The case for viewing DA as a commodity service and cost-driven race to the bottom:

At its core, DA solutions provide a reliability function for rollups - allowing transaction data to persist over long timeframes so it remains accessible across clients for state derivation and withdrawal purposes. This data storage and serving requirement has parallels to cloud infrastructure offerings.

And infrastructure services, across computing, networking and storage categories, have consistently trended towards commoditization over time as our question notes. The drivers behind this apply to DA as well:

Economies of Scale: As DA providers grow to serve more rollups and shards, they reap significant fixed cost savings that smaller niche players cannot match. Giants like AWS and Azure exemplify using sheer size and massive data centers to undercut niche cloud infrastructure providers on costs. Cloud infrastructure has demonstrated how economies of scale allow providers to drive surprisingly low costs over time for commoditized services like object storage, bandwidth, and computing. There is precedent for scale significantly reducing margins.

Rapid Technology Maturation: The tooling and best practices for managing distributed data storage and query infrastructure are advancing quicker than ever thanks to public cloud maturation. DA providers can leverage proven foundational tech like distributed databases, erasure coding, and indexing to deliver availability services without substantial proprietary innovation. Quickly commoditizing the core technology stacks. Many core distributed systems technologies like erasure coding, content addressing, and global replication are now well-understood and increasingly adopted from public cloud providers. This maturity could accelerate commoditization.

The baseline DA functionality mirrors simple cloud object/blob storage demands rather than specialized needs. Metrics like query throughput, latency, consistency, and, of course, ultra-low Total Cost of Ownership (overall expenses accrued over the lifespan of operating and managing a system) are shared requirements between both rollup availability providers and commodity cloud storage services, further driving commoditization.

In essence, DA solutions compete to provide a "good enough" reliability function that supports withdrawals and state proofs for the lowest viable cost. Just as cloud infrastructure has become dominated by economies of scale, the base DA needs seem primed for cost-driven commoditization as well rather than more bespoke reliability engineering.

The upcoming EIP-4844, also known as "proto-danksharding," will provide a significant boost to data availability for rollups and sidechains by reducing costs. Here is a brief overview:

Native DA Layer: EIP-4844 introduces a native data availability layer to Ethereum, allowing rollups and sidechains to post data in a highly robust and decentralized way.

Predictable Data Storage Costs: By having an invariant cost model for data, gas fees for data availability become predictable. This is a major improvement over reliance on calldata for posting data.

Cheaper than Calldata: The gas costs for using the native DA layer data blobs are expected to be considerably cheaper than putting rollup data in calldata. Estimates are 1/10th the cost.

Data availability via proto-danksharding will be a game changer. We wrote about the influence of EIP-4844 on data availability, shared sequencing, and Ethereum fee markets in detail here: Road to Danksharding. It would help a bit if you read this (EIP-1559) before diving deep into EIP-4844.

Open Question: Will competition emerge on cost or community alignment?

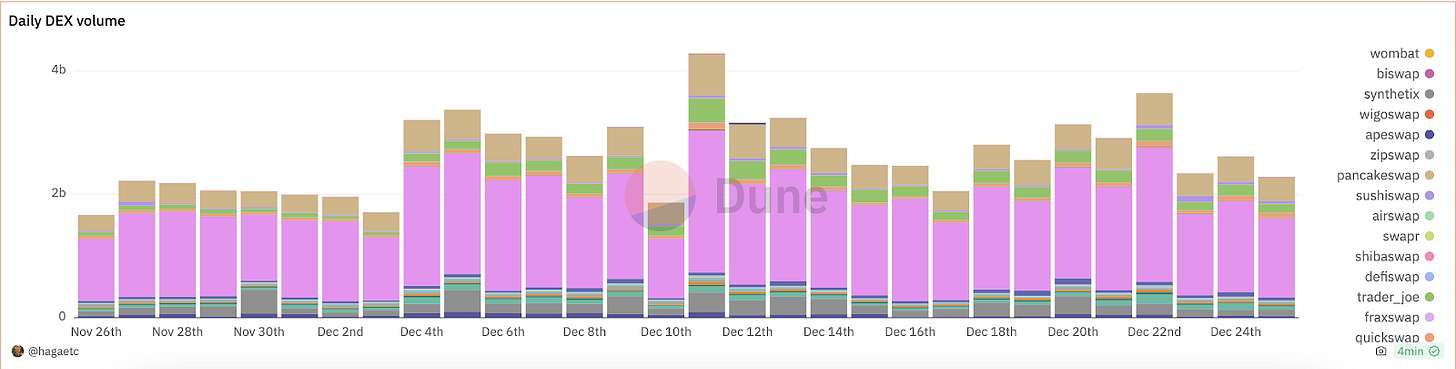

Trend #3: DEXs and Perpetuals (Derivatives)

DEXs

DeFi has been witnessing significant changes, especially within DEXs and perpetual contracts. The year 2023 has seen groundbreaking shifts and trends in this space, marking a pivotal moment in the crypto community’s development and adoption of these technologies.

Surge of Solana in the DEX Space

One of the most noteworthy trends in 2023 has been the meteoric rise of Solana in the DEX market. Historically dominated by Ethereum, the DEX landscape saw a dramatic turn when Solana briefly surpassed Ethereum in DEX trading volume in December. Solana’s DEXs registered a trading volume of $1.536 billion, momentarily eclipsing Ethereum’s $1.164 billion during the same period. This shift indicated Solana’s growing influence in DeFi and its robust growth trajectory.

Two key elements fuelling Solana's ascent in the DEX space have been the USD Coin (USDC) stablecoin and the emergence of the Bonk memecoin. Bonk, particularly, has seen a rapid rise in market capitalization, becoming the third-largest memecoin by market cap. This surge in trading activity was not limited to digital assets alone; it also impacted the physical world, as evidenced by the sell-out of Solana’s blockchain-enabled Saga smartphones, with secondary sales reaching remarkable prices.

Shift Towards Cross-Chain Strategies

Leading DEXs such as dYdX, Pancakeswap, Uniswap, and Vertex have started embracing cross-chain strategies. Initially finding success on single chains, these platforms are now expanding to multiple chains to develop better products for their users. This move towards cross-chain interoperability signifies a maturing market and the need for more integrated and comprehensive DeFi solutions.

Cross-chain dex development allows tapping into the strengths of different blockchain networks. Leveraging Solana's speed for order matching while settling on Ethereum's security promises the best of both worlds. However, making these cross-chain systems work cohesively will require top-notch developer experience across frameworks like Wormhole and Connext. There is also the risk of increased centralization with bridges and liquidity siloed at only dominant hubs. Tackling these concerns will be pivotal as interoperability gains traction.

Perpetuals

The perpetual DEX landscape is characterized by a variety of innovative models. Protocols like dYdX replicate the Central Limit Order Book (CLOB) model, while others like DriftProtocol adopt a hybrid approach, combining traditional order books with automated market makers (AMMs) for effective on-chain matching. GMX and Kwenta.io have introduced novel Liquidity Pool (LP) models, with Kwenta.io leveraging the Synthetix Debt Pool to minimize slippage and facilitate trading in synthetic assets and perpetual futures. So we have seen protocols building and innovating.

Perpetuals have emerged as the go-to derivative instrument in crypto markets, catering seamlessly to leverage trading needs of both retail and institutional traders. Their flexible open duration and funding rate driven index price alignment results in a trading experience akin to spot markets. This intuitive appeal makes increased adoption inevitable.

Protocols are innovating along multiple dimensions:

novel AMM algorithms to mimic order book behavior,

combinations of order books and AMM pools,

liquidity pools with pooled leverage, and

custom app-specific L1/L2 solutions.

This expanded design space promises creation of products with unique value propositions.

The total potential market cap for these products adds up to over $1 trillion in monthly trade volumes across CEXs and DEXs. Perp DEXs have only scratched the surface, capturing a 3-5% share historically. But the innovation and DeFi mindshare make a doubling or tripling of market share over the next year seem feasible.

Perpetuals account for a relatively small portion of the total open interest (OI) on crypto exchanges, representing only 3% or $600 million of the $20 billion total OI on CEXs. The trading volume on decentralized perpetual platforms, after peaking in Q4 2021, has been on a downtrend, except for a spike in Q1 2023, indicating a fluctuating yet growing interest in this sector. Notably, dYdX dominates the decentralized perpetual protocol market with a 58.8% share, followed by other players like GMX and Level Finance.

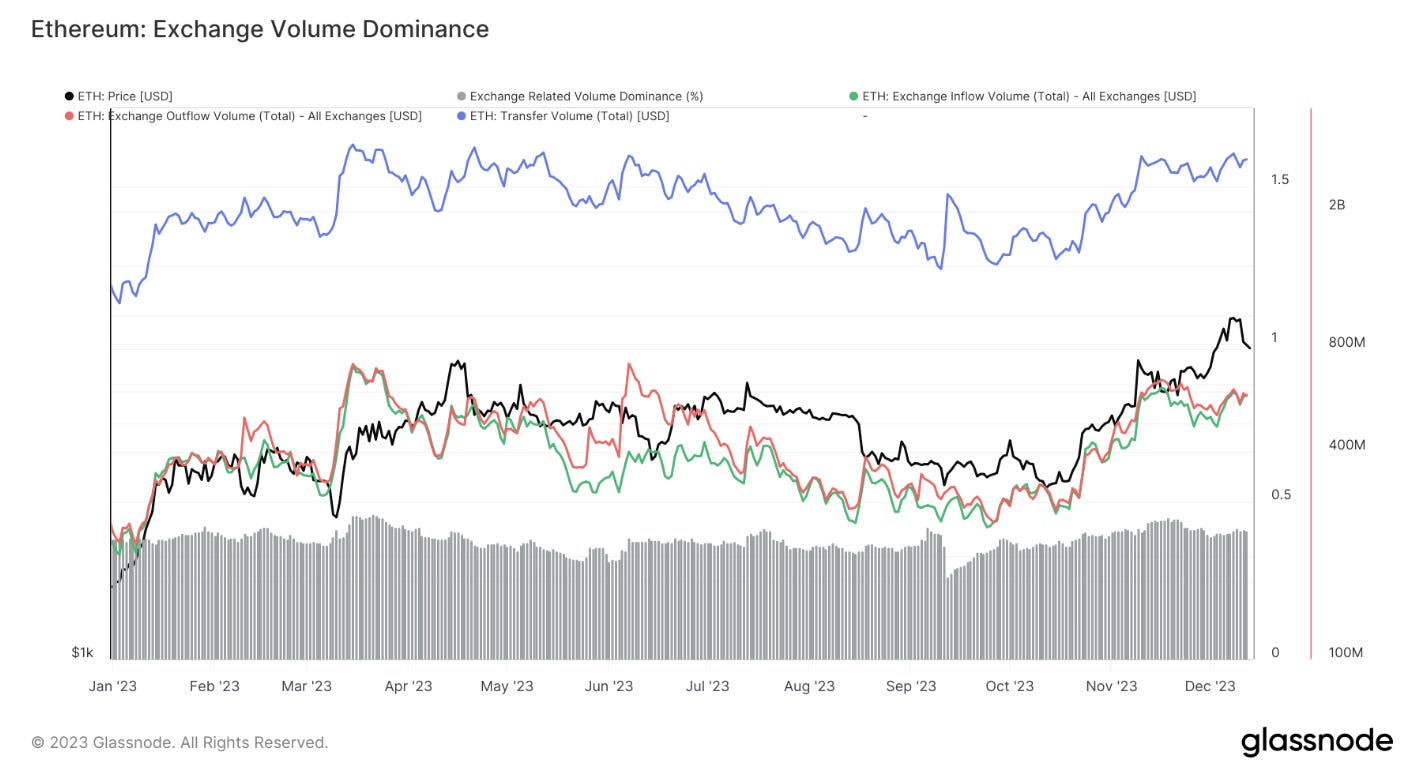

There are several compelling reasons why DEXsand Perpetuals are key trends to watch in the coming year:

Shift Towards Decentralization in Trading: There's a notable shift from centralized to decentralized exchanges, as evidenced by Ethereum's ecosystem. The decline in Ethereum balance on centralized exchanges (29.7% decrease to $14.21 million in ETH in December 2023 from $20.23 million in ETH earlier in January 2023) and the concurrent increase in TVL in Ethereum-based DeFi (from $22.16 billion to $27.63 billion) highlights a pivot towards DeFi. This trend indicates a growing preference for decentralized and more autonomous financial solutions.

The accelerating withdrawals of Ethereum from centralized exchanges to private wallets or DeFi platforms indicates rising confidence among crypto investors to take custody into their own hands. This signals a maturation where concerns over safely storing private keys are getting gradually addressed through solutions around seed phrase backups, account abstractions, social recovery wallets, and insurance products. The trends validate growing mainstream comfort with principles of self-sovereignty.

The innovations in DEXs and Perpetuals, particularly those operating on efficient blockchain networks like Solana, showcase a trend toward more sophisticated trading platforms. For example, Jupiter, the top DEX on Solana, with a daily trading volume of over $180 million, demonstrates how these platforms are evolving to offer better liquidity, speed, and user experience.

Foreshadows an Evolution to Sophisticated Algorithmic Trading

The increasing volume of exchange inflow/outflows relative to overall network activity indicates the growing sophistication of trading strategies deployed on Ethereum. It likely points to adoption of advanced programmatic techniques like arbitrage, portfolio rebalancing, and liquidations across DeFi portfolio management platforms. As algorithms permeate trading, on-chain activity is bound to intensify. The numbers signify technological defensibility allowing sustainably decentralized and transparent financial use cases to gain traction.

Open Question: Can long-term sustainability match early growth and volumes?

Trend #4: All Things Zero-Knowledge (Rollups, Coprocessors & ZKML)

Zero-knowledge technology has garnered substantial traction as a tool for enhancing scalability, privacy, efficiency, and functionality across blockchain systems. Specifically, 2023 marked extensive zero knowledge proof deployment, epitomized by high-profile launches of multiple zk-rollup networks designed to boost Ethereum transaction throughput.

Just a refresher, rollups involve bundling or "rolling up" batches of transactions off-chain before submitting condensed cryptographic proofs to the main chain, minimizing fees and congestion. Two main rollup variants exist – optimistic rollups with fraud proofs and ZK (zero knowledge) rollups leveraging novel zero-knowledge proofs for validity attestations without revealing underlying data. Due to their ingenious cryptography, we believe ZK rollups might be the king of spades and ultimately overtake market share.

ZK rollups initially struggled with EVM incompatibility, but new zkEVMs resolve this by elegantly facilitating EVM smart contract migration, as showcased through various 2023 zkEVM mainnet debuts of zkSync Era, Polygon zkEVM, Linea, Scroll and Taiko (an L2IV portfolio company). Parallel growth of rollup deployment simplification platforms (Rollups as a Service ‘RaaS’) further lowers the threshold for ongoing ZK innovation.

Looking beyond rollups, zero-knowledge techniques offer multifaceted applications like off-chain data relay and complex computation via “ZK coprocessors” without compromising decentralized security assurances. By generating proofs validating correct off-chain execution, dApps can unlock new functionality realms traditionally constrained by blockchain’s limitations. For example, coprocessors could allow L2 DEXs to implement opaque trading mechanisms or on-chain games to conduct intensive behind-the-scenes processing - all while benefiting from the robust integrity guarantees of Ethereum.

These capabilities relate to simmering discussions around optimizing dApp engineering frameworks. There are arguments for transitioning foundational infrastructure off-chain while retaining blockchain for permissionless settlement finality. There has been constant thinking suggesting rethinking the notion that everything requires on-chain enclosure, citing models like ZK coprocessors, which demonstrate that off-chain can confer equal or better effectiveness. However, fully exiting smart contracts risks unintended tradeoffs.

Smart contracts are revered for their efficient, automated code execution. However, their predefined rigidness sometimes hinders adaptability, especially in dynamic situations. This is where machine learning could confer improvements. ML models trained on massive datasets can continuously learn, adapt, and drive accurate forecasts. Integrating these capabilities into smart contract logic unlocks more customizable and intelligent capacities.

A major hurdle with on-chain ML remains the sheer computational overhead. This gave rise to Zero Knowledge Machine Learning (ZKML) - fusing zero knowledge proofs with off-chain ML to allow verifying model integrity without exposing underlying data. In this architecture, models train off-chain then generate proofs validating prediction accuracy for on-chain verification.

ZKML hence unlocks AI-powered smart contract versatility while still ensuring blockchain's inherent transparency and security. For example, automated market makers could leverage ZKML for long-tail asset pricing based on advanced ML valuation models, with validity proofs preventing exploitation. Prediction markets also benefit from enhanced crowd wisdom mining and assurance.

One example we saw was of Upshot's ZK Predictor using Modulus Labs zero knowledge circuits. This allows Upshot to securely harness complex data for asset appraisals, with Modulus technology encapsulating the AI's computations into proofs that verify to blockchain without revealing actual model mechanics or training data.

A concrete use case demonstrating the power of ZKML is that of Sturdy V2 with Risc Zero. This yield aggregation protocol aims to optimally allocate user funds across whitelisted lending pairs to maximize returns. However, determining ideal asset distributions to maximize yield poses an optimization challenge suitable for advanced algorithms. Although AI could solve this allocation problem, performing such heavy computation on-chain would be prohibitively expensive. This is where Sturdy leverages RiscZero's ZK coprocessor to enable verifiable off-chain computation.

Specifically, RiscZero's solution allows running ML algorithms off-chain while generating zkproofs that attest to the correctness of the asset recommendations. These proofs can be verified on-chain to validate algorithm integrity without exposing underlying intellectual property. This architecture provides major advantages to Sturdy users. First, yields are maximized through optimized AI-driven allocations. Second, gas costs are slashed by keeping intensive computation off-chain. And third, the zero knowledge proofs retain assurances around computation integrity. So in tangible terms, Sturdy V2 users can soon deposit funds into aggregated lending pairs personalized to their risk preferences, earning superior yields from AI-optimized allocation without expensive rebalancing or gas fees. The zk proofs guarantee computation validity without exposing proprietary models themselves.

At a high-level, the solution aptly demonstrates ZKML's value prop - customized ML algorithms for optimization tailored to the application, combined with trust minimization and gas efficiency from proofs verification without exposing sensitive IP or data. This could expand to other recommendation systems like personalized portfolio construction, credit modelling for on-chain underwriting, automated strategy rebalancing in DeFi, and more. Crypto native apps may lean more heavily into these techniques compared to traditional firms, given lower regulatory overhead.

But even initial proofs-of-concept demonstrate the immense potential of marrying AI and blockchain through cryptography. We truly believe exploring hybrid on- and off-chain schemas may grant ideal paths forward as the vision of modular ecosystem maturation continues.

ZK + Privacy

Another use case to look into as zero-knowledge proofs become integral is within blockchain's transparency with privacy demands. One such example is Elusiv, which brings programmable confidentiality to Solana using established zk-SNARK constructions. By compiling high-level privacy circuits with systems like Circom into proofs that validate without exposing, Elusiv taps into the promise of mathematics to enable trustless anonymity. This allows relying on provable security instead of obscurity unlike previous mixers and tumblers. Yet unlike maximalist privacy chains severing auditability, Elusiv retains decentralized compliance making anonymous transactions viable at scale.

Its growth into an interoperable confidential layer will test whether zero-knowledge technology has crossed the chasm from cryptographic curiosity to an indispensable privacy apparatus across institutional blockchain adoption. Regardless, by addressing usability gaps of existing and compliance-restricted mixers and privacy networks, Elusiv's ability to reconcile the needs of confidentiality and accountability serves as an essential on-chain service for institutions and consumers alike.

Open Question: Is off-chain a necessity or dilution of decentralization?

Trend #5: Decentralized Physical Infrastructure (DePIN)

The world has grown dependent on large centralized providers controlling critical infrastructure like the internet, cloud computing, wireless connectivity, and more. A handful of opaque corporate gatekeepers dominate these trillion-dollar industries, extracting value while innovation stagnates. What if there was a better way to manage the infrastructure platforms we all rely on - one that is more transparent, fair, resilient, and empowering? Enter decentralized physical infrastructure networks (DePINs).

DePINs are blockchain-based networks that coordinate the buildout and operation of physical infrastructure, from data centers to wireless coverage, more efficiently than legacy providers. By leveraging crypto-economic incentives and community alignment, they promise to unlock the decades-old bottleneck of infrastructure centralization.

While the vision of DePIN has existed for years, 2024 could mark a pivotal moment for mass adoption due to several key trends aligning:

Inflationary pressures are driving the desire for lower-cost alternatives to legacy services amidst economic turbulence, perfectly aligning with DePIN value propositions around community ownership reducing costs.

Web3 participation has strengthened with prior crypto market cycles, priming a ready user base willing to contribute devices and assets to bootstrap network effects for DePIN platforms.

Maturing crypto-economic token models (1, 2) and reduced speculation is allowing protocols to focus resources on real-world utility over marketing, leading to demonstrations of sustainability.

Enterprise interest in tokenized business models and blockchain-enabled resource coordination is at all-time highs based on institutional capital inflows, pointing to future private sector utilization of DePIN networks at scale.

The collective momentum across these vectors explains why decentralized physical infrastructure adoption seems poised for an inflection point. Technological readiness, demand drivers, and proven real-world capacity combine to set the stage for an escape from niche footing into the mainstream.

Specifically, if we look at the telecom industry, behemoths like AT&T and Verizon have accumulated tremendous control over access and profits. They charge monopolistic fees for spectrum access and basic connectivity while customer service suffers.

DePINs like Helium and Althea are proving that decentralized grassroots networks can provide wireless bandwidth at lower cost, higher quality, and with community ownership. Anyone can participate by deploying some basic hardware and earning tokens in return.

The same dynamic is playing out in

decentralized storage (Filecoin),

compute (Golem),

sensors (Presence), and

identity (Civic).

What's unique about DePINs is that they create a positive feedback loop as they grow - accumulating more resources and aligning more interests within each network.

For Helium, more wireless hotspots mean wider coverage at lower latency plus additional value-added services.

For Filecoin, more distributed storage capacity means lower prices, better reliability and availability, and now additional computation use cases in web3.

For Livepeer, more video transcoding miners means higher definition multimedia content can stream across the decentralized web. It unlocks adoption by platforms like Twitch, YouTube, and TikTok to tap censorship-resistant infrastructure.

For Ocean Protocol, each new valuable dataset onboarded expands the data supply available to AI consumers. More data asset liquidity begets more model developers, thus more service demand. Eventually dominating vertical use cases currently relying on Big Tech corporates for intelligence.

This self-reinforcing flywheel is extremely powerful.

While traditional infrastructure plays suffer from diseconomies of scale, bureaucracy, and misaligned incentives between shareholders, employees, and users, DePINs largely avoid these issues by automating governance and simplifying participation through tokens. There's no need to trust CEO decisions or sign restrictive Terms of Service. Everything is voluntary, transparent, and community-driven. Solutions emerge organically from users and developers themselves.

With over $20 billion in market value across 650+ networks, DePINs are gaining tremendous momentum with support from top crypto investors. Annualized revenue exceeds $15 million generated on-chain, cementing real-world usage beyond speculation.

The trend boils down to consolidating the ecosystem into

Consuming vs. Providing infrastructure resources as

Network Extractors & Network Contractors

Capturing vs. Creating value in the network as

Capacity Lessees & lessors.

This is still just the beginning. However, realizing the potential requires avoiding past crypto pitfalls like ignoring usage in favor of speculation or insufficiently decentralized networks. Projects that focus first on building utility and usage tend to be more resilient.

For example, on-chain revenues for top DePINs dropped only ~20-35% during the last crypto bear market compared to over ~70% for most other crypto verticals.

As DePINs mature technologically and economically, they will continue intersecting with bleeding-edge trends like zero-knowledge proofs for privacy and verifiable claims, AI integration directly on-chain, play-to-earn gaming built on real-world activity, and viral memecoin distribution tactics. We will witness unexpected "vampire attacks" on legacy Web2 infrastructure as decentralized alternatives siphon off demand by better incentivizing users.

No one can predict how quickly decentralized regimes will displace the old guard, or which projects will lead the revolution. But the economic gravity of transparent, community-owned infrastructure is inevitable. The dominant platforms of today will eventually go the way of Ma Bell telephone monopoly or Myspace social network. Too much value will flow into open networks that grow stronger the bigger they get.

Of course, decentralized systems bring their own challenges like governance disagreements, incentive misalignments, regulatory uncertainty, and technical shortcomings. Not every DePIN project will succeed or be sufficiently decentralized in practice. But for an individual or collective trying to exit the prevailing regime of infrastructure control, or unlock and capture new value from physical networks, DePINs represent the most credible path forward.

Open Question: Can they decentralize sufficiently and avoid speculation distractions?

Trend #6: Real-World Assets (RWAs)

The concept of representing real world assets like real estate, invoices and commodities on the blockchain has rapidly gained momentum since 2020.

With initially only seeing the adoption within

Collectibles & Art (fine art, rare books, jewelery),

Financial assets (Public equity, treasuries, debts, and commodities) and

Real estate (commercial, residential, debt),

This process of asset tokenization saw exponential growth through 2023, with over 100% increase in number of tokenized products coming on-chain, with new verticals emerging in

Infrastructure (Energy infrastructure, Renewables),

Gaming (IPs, royalties, physical assets) and

Data (Personal, financial, IoT).

This process of asset tokenization saw exponential growth through 2023, with over 100% increase in number of tokenized products coming on-chain across verticals, and 2837% increase in TVL from January 2022 ($178 million) to January 2024 ($5 billion).

A major part of this growth has come from stablecoins (discussed in next section) backed by real world assets instead of just fiat collateral. These RWA-backed stablecoins have carved a niche for usage in global trading and remittances. They provide the twin benefits of cryptocurrency systems as well as stability through asset backing.

Ethereum remains the leading blockchain for asset tokenization by total value, with over $1.5 billion in real world assets represented. This includes assets across real estate, gold, invoices, and more. Stellar and Polygon follow in second and third place, with $300 million and $116 million tokenized so far, with treasuries being the most tokenized assets.

The reasons for Ethereum’s lead are understandable when we consider the transformative impact that blockchain technology can have. Processes for securitization of loans and assets involve multiple intermediaries today, leading to higher costs and complexities. Blockchain enables automation through smart contracts, reduces costs and speeds up processes. Originators can now collect royalties on secondary trades, open credit scoring models can be built, and sale costs can be significantly reduced.

These real-world asset protocols are effectively collaborating with traditional finance institutions and attracting their interest in blockchain adoption. JP Morgan, Wells Fargo have also shown willingness to experiment with RWA technology. The scale of TradFi and DeFi collaboration has reached unprecedented levels in 2023.

For crypto-native entities like DAOs, tokenization provides previously unavailable opportunities in asset ownership and treasury management. Even intangible assets like intellectual property and patents are getting tokenized, promising more monetization avenues for individual creators.

As we look forward to 2024, integration of RWAs into DeFi is poised to accelerate even faster. Protocols facilitating asset tokenization and on-chain representations will gain more adoption.

With asset tokenization, the market can transfer both tangible and intangible assets like real estate as well as patents and copyrights respectively. RWA protocols are bridging to traditional finance markets, allowing more decentralized and efficient models for investment and growth.

Despite regulatory uncertainties that remain, the opportunities for efficiency, transparency, and accessibility improvements through asset tokenization continue to drive rapid innovation in this space. The balance between permissionless innovation and regulation will shape the final impact of RWAs.

Open Question: What is the ideal balancing innovation pace and necessary regulation?

Trend #7: Stablecoins

Stablecoins have risen in popularity as they enable several key functions - acting as a hedge against currency volatility, facilitating cross-border transfers and remittances, and allowing movement of funds between cryptocurrency exchanges and DeFi platforms. A major reason behind their success is the accessibility they provide to U.S. dollars, especially for overseas individuals who face difficulties or barriers in directly accessing USD otherwise.

As the demand & utility for stablecoins continues to grow, there are opportunities to further mature stablecoin solutions. On the technology side, different models are being explored to achieve an optimal balance between stability, scalability, and decentralization. Asset-backed stablecoins using real-world collateral like commodities and government securities can help minimize volatility. Solutions around user onboarding, education and simplifying access are also vital for driving mainstream adoption across retail and institutional users.

As we saw earlier in the RWA trend section, Ethereum-based tokenized U.S. Treasuries have gained some traction as they allow representing traditional assets over blockchain rails. However, availability remains constrained to professional investors in select jurisdictions due to compliance requirements around custody and redemption. Over time, such tokenization could help connect traditional and digital asset finance.

For most everyday users, fiat-backed stablecoins like USDC or Tether's USDT remain the most popular due to their relative stability and liquidity. Though decentralized algorithmic stablecoins offer theoretical advantages, they are yet to demonstrate real-world viability at global scale and adoption as a widespread medium of exchange.

As stablecoins have become deeply integrated and being widely used as a quoting currency-- this reliance became evident in the last market cycle where aggregate stablecoin supplies played an outsized role.

Total stablecoin market capitalization had reached an all-time high in May 2022 ($178B), but dropped 26% from those peak levels in January 2023. This decline can be attributed to a confluence of factors - ranging from regulatory actions like the SEC charges against Binance's BUSD, rotation into interest-bearing assets like U.S. Treasuries, and dampened investor appetite in a prolonged bear market.

As of January 2024, the total market capitalization of stablecoins stands at $133.75 billion.

The draining liquidity has been a major headwind at a time when trading volumes and volatility have already dried up. However, stablecoins remain embedded in exchange workflows. As such, their ubiquity and importance in enabling transactions provide a strong case for not just U.S. dollar-denominated offerings but also euro and yen alternatives to facilitate global accessibility.

Speaking of regulations, the Financial Services and the Treasury Bureau (“FSTB”) and the HKMA have released a new consultation paper outlining a proposed regulatory overview for fiat-referenced stablecoin issuers. This represents an important step towards providing guardrails and protections in the evolving stablecoin landscape.

The motivation stems from risks around stablecoins failing to uphold pegs and disrupting economic activities. To mitigate such threats, the proposal plans to introduce stablecoin issuer licensing requirements and stabilization mechanisms like high-quality reserve asset backing. Redemption rights at par value are also proposed. Additionally, the consultation paper calls for governance, risk management, and AML safeguards while restricting stablecoin distribution to only licensed issuers.

The move aligns with global policymaker efforts to balance stablecoin innovation opportunities with financial stability imperatives. It reinforces the importance of delivering reliability assurances to realize mainstream potential. The consultation also underscores how maturing stablecoin solutions must instill trust by reconciling decentralization with pragmatic stabilization and accountability guarantees. Hybrid models adhering to jurisdictional norms could enable global reach.

This ties well back into the overarching RWA theme around bridging traditional and digital asset realms. Compliant stablecoin issuers, for instance, could fluidly transmit stable purchasing power across blockchain rails, spearheading convergence.

Open Question: Can algorithmic stablecoins achieve global scale and mainstream usage without crypto-collateralization if asset-backed models succumb to regulatory clampdowns?

Trend #8: Intents

Decentralized finance (DeFi) holds great promise to deliver financial access through disintermediation. However, critics have long argued that current DeFi systems are too complex for mainstream adoption. Interacting with DeFi protocols typically requires manually constructing intricate, multi-step transaction pathways - approving tokens, bridging assets across chains, setting slippage and gas fees, and more. This burdens users with unnecessary complexity.

Now, the concept of “intents” aims to change all of this. Instead of needing to understand transactions, users can simply declare their overarching goals or “intents” in plain language. For example, “I intend to acquire 2 ETH on Optimistic Ethereum using my USDC tokens on Mainnet Ethereum when ETH drops below $1600 in the next 3 days.”

This high-level intent encapsulates the user’s desired outcome without any transaction specifics. It is relayed to an automated “solver” system that specializes in decoding intents and fulfilling them through optimized transactions. These solvers could be middleware protocols or professional market-maker entities equipped with trading algorithms, liquidity bridges, arbitrage infrastructure, and more for interchain execution.

Upon receiving a user’s intent transaction, the solver parses it, formulates an optimal transaction pathway to fulfill the goal, and executes trades across necessary protocols and chains - while charging the user a small fee. The user simply waits for their desired outcome while all complexity is handled behind the scenes by the infrastructure purpose-built for this job.

Some Key Trends We are Following

Convergence of Liquidity and Specialization

In intent-based infrastructure, execution responsibility converges from end-users into dedicated solver entities. This reflects growing specialization and professionalization of market making in DeFi. Sophisticated algorithms can extract profits from volatility and arbitrage far better than regular users, so shifting execution onto professionally managed systems unlocks efficiency. There is also likely to be a convergence of liquidity from disparate DEXs into centralized exchange-like aggregated pools. This will allow solvers faster and cheaper access to liquidity needed to fulfill user intents, especially cross-chain intents.

Shift Towards Off-Chain Computation

Another trend is the movement of execution itself off-chain when feasible, with only settlement transactions hitting layer-1 chains for security. Solvers may turn to centralized exchanges as liquidity sources, then settle token swaps on Optimistic Rollups in batches to reduce costs. Avoiding direct layer-1 transactions provides substantial savings on gas fees.

Linkages bridging crypto with mainstream finance are also probable. Solvers may leverage traditional banks, prime brokers, and trading firms as part of bridging assets and executing user intents across both crypto and fiat currency environments seamlessly.

Focus on Simplicity of User Experience

Finally, the rise of intents reveals a pivotal shift - away from retaining all complexity on L1 in pursuit of decentralization towards simplifying user experience by outsourcing complexity off-chain, even via some centralization. Mass adoption requires appropriate abstraction of unnecessary intricacies without sacrificing censorship resistance at the settlement layer.

While this approach offers substantial usability improvements, some inherent downsides exist.

Firstly, relying on solver intermediaries may reintroduce third-party dependencies.

Secondly, extensive off-chain computation and exchanges with centralized entities dilute auditability and verification assurances.

Finally, solver fees are likely to accrue over time, especially if the system entrenches oligopolies.

This shift marks an important step towards unlocking mainstream DeFi adoption by abstracting unnecessary complexity.

Open Question: Does relying on intermediary solvers to decode intents and execute on behalf of users reopen dependencies on trusted third parties and reduce auditability compared to on-chain transparency?

Trend #9: Bitcoin Market Updates

At the start of the year, we all prayed and speculated around when will Bitcoin cross the $30k mark. We finally got an answer in the past few weeks.

The Bitcoin market has demonstrated exceptional strength in the later part of 2023, surpassing multiple technical and on-chain pricing models.

As we all noticed, throughout 2023, Bitcoin prices found themselves oscillating between the least volatile periods in the cryptocurrency's history. This period of calm was briefly disrupted when a swift deleveraging event in August caused a dramatic drop in prices, from $29k to $26k, falling below both the aforementioned long-term averages.

The market dynamics point to a potential pause or pullback following exceptional performance. Specifically, Bitcoin rose to break the $44.5k level to reach a new peak for the year so far. However, it experienced the 3rd largest sell-off of 2023 subsequently. This round trip indicates the rally faced significant resistance on approach to $45k.

However, the real game-changer came in October, with a rally that not only recouped all previous losses but also shattered the crucial psychological barrier of $30k. This surge led Bitcoin to its yearly high of $44.5k, with a current consolidation around $42k.

The acceleration of capital flows and market momentum since late October is a central theme of this analysis. This was particularly evident when Bitcoin prices broke above the $30k level, transitioning from an 'uncertain recovery' phase to an 'enthusiastic uptrend'.

Additionally, the rise in exchange inflow and outflow volumes for both BTC and ETH throughout the year suggests a growing interest in spot trading. Notably, BTC volumes have increased more rapidly than ETH, a common trend following long bear markets:

In 2011, Bitcoin crashed from $32 to $0.01 due to a major security breach and bitcoin theft at the Mt. Gox exchange. It took over 2 years for Bitcoin to recover to its previous high.

In 2014-2015, Bitcoin crashed from over $1,000 to below $200. This was attributed to crackdowns on Bitcoin by Chinese financial institutions as well as major exchanges like Mt. Gox halting operations due to hacks and thefts. The bear market lasted over a year.

In 2018, after hitting an all-time high of $20,000 in late 2017, Bitcoin crashed to below $3,200 within a year. Major factors included hacking of exchanges like Coincheck, advertising bans by the likes of Facebook and Google, and rejection of Bitcoin ETFs by US regulators.

In mid-2021, Bitcoin fell from $63,000 to around $29,000 within months. Concerns over the environmental impact of Bitcoin mining, as well as mining bans in China, contributed to this crash. However, it lasted only a few months.

In 2022, Bitcoin crashed from an all-time high of $68,000 to below $20,000 in June. Major stablecoin crashes like that of TerraUSD triggered this latest bear market which wiped out nearly 2 years’ worth of price gains.

Bitcoin has always recovered from crashes eventually, as we saw in 4Q 2023.

Bitcoin transaction counts also reached new highs due to the rise of Ordinals and Inscriptions. These transactions, which embed data such as text files and images within Bitcoin transactions, have led to a significant increase in both the number and types of transactions.

Despite inscriptions accounting for about 50% of confirmed transactions, they surprisingly occupy only 10% to 15% of block space. This anomaly is due to the small size of text files and the nuances of the SegWit data discount. Inscriptions have contributed significantly to total transaction fee revenue for miners, highlighting the complexity of SegWit's impact on transaction fees and block space.

On the topic of Inscriptions and Ordinals, BRC-20 has been taking Bitcoin by storm.

The emergence of Bitcoin ordinal inscriptions has been transformative for the ecosystem in 2023. Originally pioneered by @domodata with the release of the BRC-20 specification in March, inscriptions have enabled seamless on-chain token creation and transferal leveraging Bitcoin's blockchain.

By embedding token contract logic within ordinal inscription transactions on Bitcoin, BRC-20 ushered in a revolutionary new paradigm. One that moves key functionality like minting and transfers directly onto Bitcoin's base layer in a decentralized manner.

The innovations have also sparked broader industry adoption. Inscriptions are now spreading to other chains as ways to embed arbitrary data. However, their popularity has also been a double-edged sword. Chains like Arbitrum and zkSync faced congestion issues earlier last week due to widespread inscription spamming.

Nonetheless, Bitcoin remains the trailblazer, with ordinal inscriptions forming a majority share of its transactions. Around 60% of Bitcoin transactions are currently BRC-20 ordinals carrying inscription data. Given the growth ahead for inscription-based tokens and contracts, this metric can rise further.

Open Question: Can inscription popularity and congestion be managed?

Trend #10: Solana Market Updates

Solana has been flying lately. Never in the history of cryptocurrencies and blockchains has any crypto made a miraculous recovery after being slashed down ~97% two years ago.

Solana's price fluctuations in the past were heavily influenced by external factors, including the FTX collapse. However, the underlying blockchain technology remained fundamentally sound. This resilience played a crucial role in its recovery. By the end of 2023, Solana's price saw a remarkable increase, valued at around $111.7 (As of 27th Dec, 2023), which marks a staggering growth of over 900% in less than a year. This recovery mirrors Solana's performance in 2021, showcasing its ability to reclaim a prominent position within its sector.

A key factor behind the price increase is Solana's unique consensus mechanism, Proof of History (PoH). PoH orders transactions using cryptographic timestamps, enabling a secure and efficient consensus. This technology enhances the scalability and security of the blockchain, contributing to higher transaction throughput and reduced computational workload. As of 2023, Solana's blockchain is capable of handling thousands of transactions per second, which is significantly higher than many other layer-1 blockchains.

In parallel, the Solana ecosystem has been growing, and growing fast.

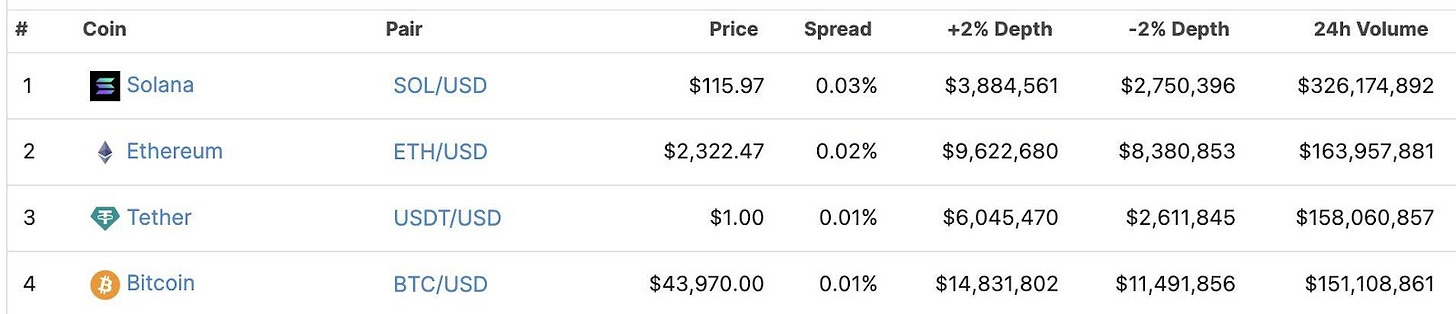

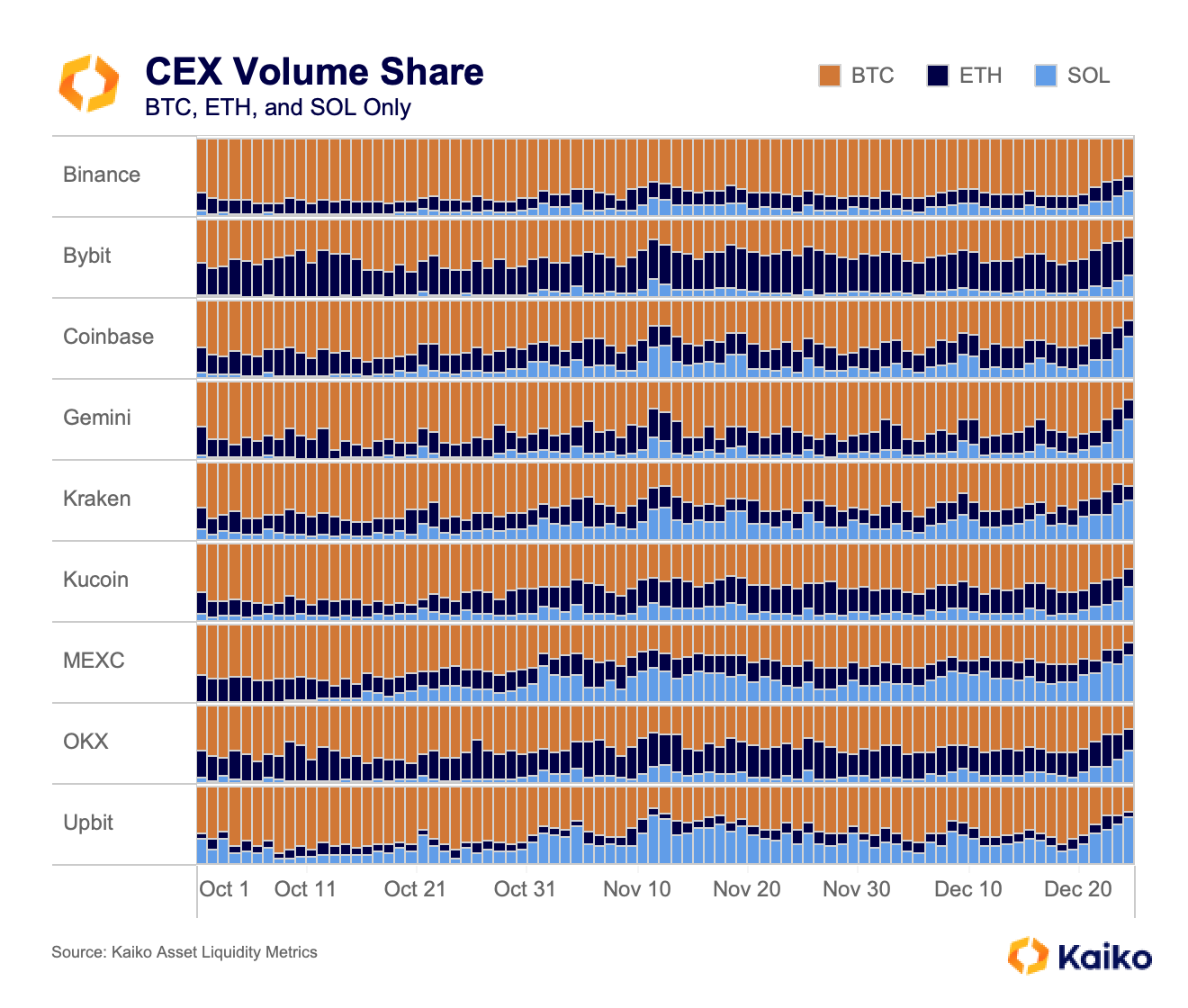

Over the weekend of Dec. 24th, Solana's trading volume on major centralized exchanges surpassed that of Bitcoin and Ethereum combined. Data from Coinbase, Kraken, Gemini, Upbit and MEXC corroborated this - showing Solana beating Bitcoin and Ethereum for 2-3 days straight.

Charts shared by analytics platform Kaiko showed Solana’s trading volume approaching 40% share of total volume on centralized platforms. Bitcoin and Ethereum volumes were declining in comparison.

Solana crossing the trading volume of Bitcoin and Ethereum over a weekend signifies an intriguing shift in momentum. As the most valuable and established blockchain networks, Bitcoin and Ethereum have dominated trading volumes since the inception of crypto. Being surpassed by the upstart Solana merits deeper examination.

On one hand, the development is largely unsurprising given Solana's meteoric growth trajectory through 2022. The network has aggressively captured mindshare through sought-after capabilities like fast speeds and low costs. These attributes have resonated with builders and traders alike.

Many of us noted this milestone is "unprecedented" and indicates sustained interest and momentum for Solana in the market right now. Key factors driving Solana's growth include its high-profile partnerships with Visa, Shopify, etc over the past year to bring blockchain payments mainstream. Additionally, buoyant interest in Solana-based memecoin BONK and resurgent DeFi activity on Solana's smart contract platform are driving investor and trader interest.

That being said, sustainability remains an open-ended question despite the milestone. Crossing Bitcoin and Ethereum momentarily does not guarantee an enduring trend. For meaningful change, Solana must entrench itself within the mainstream steadily.

Network outages and reliability challenges have hampered adoption strides historically. Moreover, Bitcoin and Ethereum benefit from established network effects that have endured bear markets. Whether Solana's volumes versus the titans prove an ephemeral blip or watershed moment depends significantly on execution ahead.

Earlier last month, it was noted that Solana’s DEX volume broke the $9 billion mark, and it has gotten better every day since. DEX trading volumes reflect growing adoption and trust in Solana's capabilities. Traders and investors are increasingly leveraging Solana-based DEXs.

The $9 billion figure exceeds previous DEX volume records on Solana. It caps a year of steady volume growth, showing the ecosystem's velocity.

The foremost factor is Solana unlocking throughput and scalability thresholds unseen before in the blockchain industry. Processing over $9 billion in DEX swaps requires handling immense transaction loads at speed and low cost. Achieving such figures showcases Solana’s real-world capacity as demand grows. And growth seems guaranteed given developer mindshare keeps rising despite industry malaise otherwise. That is because the network offers a genuinely differentiated infrastructure for builders in the space.

Open Question: Can network reliability and sustainability match late-2023 traction?

L2IV Thoughts

As we analyze the landscape, several macro factors signal an optimistic growth trajectory for digital assets in 2024.

For starters, the approval of Bitcoin ETF has driven interest and frenzy in the market and we expect it to be bullish overall. With approvals expected for Ethereum spot ETFs, we can expect an immense wall of institutional capital into crypto and see inflows stretching into the hundreds of billions from pensions and asset managers allocating to this emerging asset class through accessible regulated wrappers.

Additionally, Bitcoin's upcoming halving event has historically catalyzed multi-year bull runs by reducing selling pressure. This cyclical dynamic could fuel a prolonged price uptrend through 2025.

And if inflation continues cooling, the Fed could very plausibly reverse course into rate cuts by the end of 2024. This would undeniably stimulate risk asset appetite across global markets.

The convergence of these macro drivers seems likely to recreate conditions that powered the 2021 Bitcoin bull run. This presents a hugely favorable landscape for institutions and retail alike.

Expanding horizons on the technology front reinforces this optimism. The analysis around ZK within blockchain and AI creates a paradigm shift that resonates with our thinking - decentralized data transmission promises to unlock new frontiers in machine learning, vastly expanding systemic trading design spaces.

Upgrades enabling low-latency trade execution across diversified venues also provide low-slippage access to capitalize on everything from spot to sophisticated derivatives plays. And with base layer scalability launch and functionality growth in Bitcoin and Ethereum, tactics can trade directly on-chain rather than proxies - capitalizing on basis and arb opportunities.

In summary, Positive macro forces alongside technological expansions have us bullish on crypto systematically extracting alpha from diverse sources through 2024 and beyond.

Conclusion

As we reflect on the trajectory of innovations traced across pivotal blockchain domains, several unifying themes emerge - painting a future grounded in decentralization yet scaled for global needs. The foundational trends analyzed around scalability, interoperability, functionality and adoption indicate that core tenets of permissionless and transparent participation remain firmly entrenched into the blockchain industry's DNA even as it permeates world infrastructure.

The advent of decentralized data/sequencing schemes powering modular rollup stacks bound by staked security represents a milestone where customizability need not compromise robust composability. The vital progress in formally analyzing security tradeoffs when bridging across chains further reifies cryptography's role as the immutable anchor upholding ecosystem honesty. Advances in areas as diverse as permanent records through Bitcoin's ordinal inscription to real-time swaps via customized DEX derivatives showcase technology maturing at every layer to meet specialized demands at scale. Meanwhile, the reassuring resurgence of pioneer networks like Solana dispels doubts over platform viability.

Granted uncertainties exist, particularly around managing disputes across interdependent security domains created by inter-blockchain connectivity models which span sequencing, verification and settlement finality in cross-chain contexts. As bridges, side-chains and ZK rollups permeate asset portability - enhanced interoperability frameworks will prove critical.

Nonetheless, the trends analyzed holistically underscore that iterative, guided growth remains both achievable and preferable to more centralized attempts at enforced adoption. In the process, the unique strengths across major network ecosystems seem likely to coalesce around specialization by use case while sharing essential base resources like liquidity, state storage and computing via interoperable cryptography and proof systems underpinning validity of computations across all domains.

As we wrap this up, we at L2IV, are actively investing and exploring deals in all the trends we have listed in. The list is not exhaustive. Reach out to us if you are building in any of the above verticals.

Find L2IV at l2iterative.com and on Twitter @l2iterative

Author: Arhat Bhagwatkar, Research Analyst, L2IV (@0xArhat)

Disclaimer: This content is provided for informational purposes only and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisors as to those matters. References to any securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.