We at L2 Iterative Ventures (“L2IV”) are thrilled to have participated in Babylon’s recent $18M round.

At L2IV, we look for exceptional teams to solve complex problems through innovation. Babylon instantly attracted our attention by pioneering uncharted territory - enabling Bitcoin to provide security and earn yields in proof-of-stake ecosystems.

Here's why we are thrilled to support their vision of a BTC-secured decentralized world and the novel protocols they invent and develop:

The Challenges PoS Chains face today

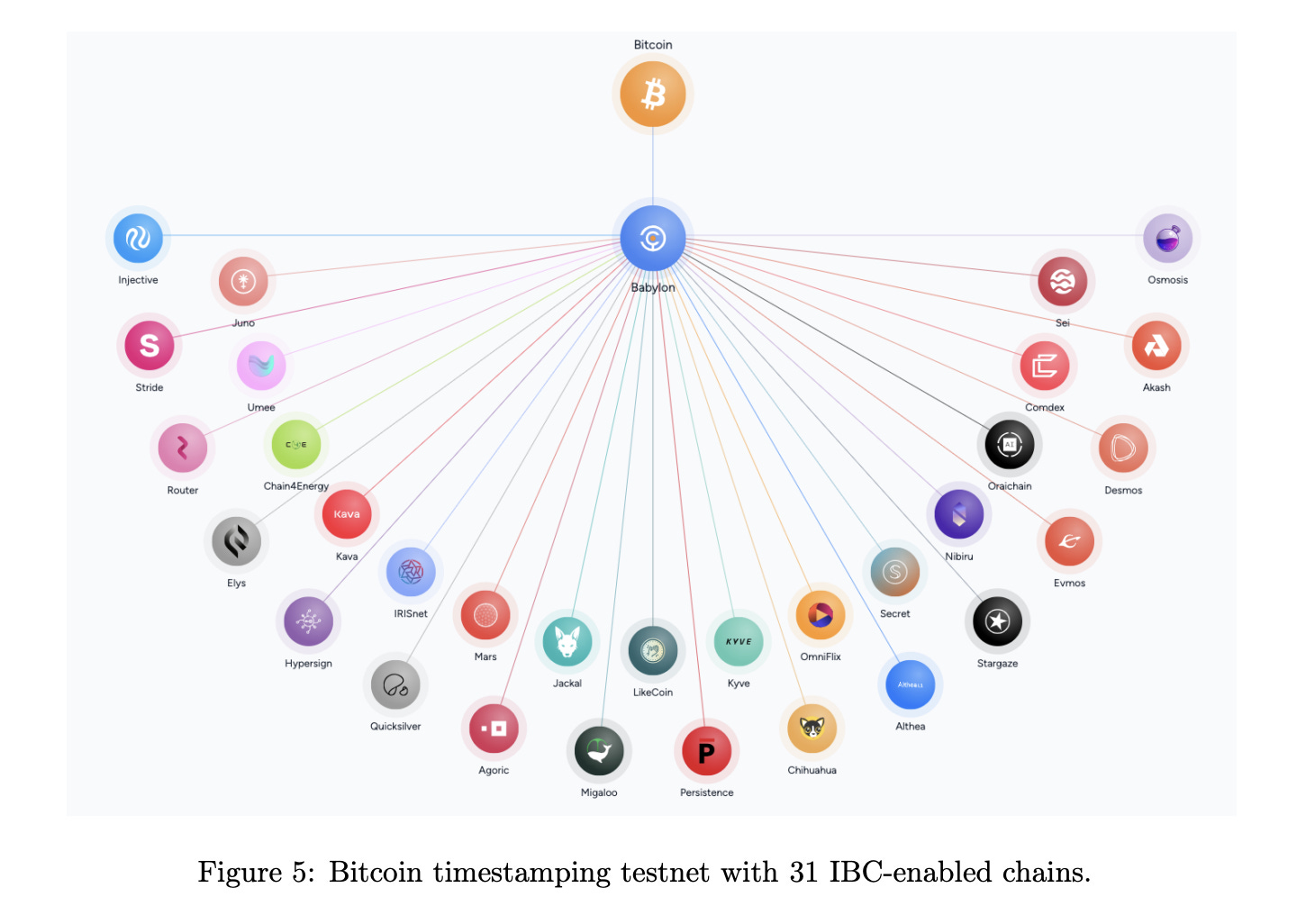

Babylon’s innovative approach to extracting various facets of Bitcoin security to address key challenges in PoS networks marks a significant advancement in blockchain technology.

1. Addressing Long-Range Attacks

Long-range attacks are a significant vulnerability in PoS networks. In these attacks, malicious validators first unstake from the canonical chain and then create a parallel chain starting from a historical point (often the genesis block) and attempt to present it as the legitimate chain. PoS networks are particularly susceptible due to the low-cost nature of block production, compared to Proof-of-Work (PoW) systems like Bitcoin.

Babylon addresses this risk through a sophisticated checkpointing system anchored in the Bitcoin blockchain. The process involves the following:

Snapshot Creation: Periodically, Babylon takes snapshots of the state of the PoS chain.

Data Aggregation and Checkpointing: These snapshots are aggregated and converted into a checkpoint. The checkpoint data is then recorded onto the Bitcoin blockchain.

Immutable Record: Once recorded on Bitcoin, these checkpoints create an immutable historical record of the PoS chain’s state at specific intervals.

This mechanism achieves two critical outcomes:

Enhanced Security: The immutable nature of the Bitcoin blockchain means that the recorded checkpoints cannot be altered, making it nearly impossible for attackers to rewrite the PoS chain history.

Faster Finality: By frequently anchoring the PoS chain state to Bitcoin, Babylon provides a more rapid and robust finality to transactions, bolstering the overall security and integrity of the PoS chain.

2. Addressing Illiquidity of Staked Assets

A key challenge in PoS networks is the illiquidity of staked assets due to the required "unbonding period" – the time it takes for staked tokens to be released back to their owners after being unstaked. This period is crucial for security but results in capital being locked up, reducing liquidity.

Babylon’s integration with Bitcoin helps to address this issue:

Faster Finality Through Checkpointing: By anchoring checkpoints in the Bitcoin blockchain, Babylon provides a more robust and faster finality for transactions in PoS chains.

Reduced Unbonding Period: The improved finality and security allow for a shorter unbonding period in the PoS networks that Babylon secures, as the risk of long-range attacks and the need for extended manual social consensus is significantly reduced.

Increased Liquidity: Shorter unbonding periods mean that assets are not locked up for as long, enhancing liquidity for token holders and validators.

What Stood Apart For Us was Babylon’s Modular Approach to Bitcoin's Structure

Babylon introduces a modular framework to Bitcoin’s traditional monolithic structure by distinctly separating two of its primary functions:

Timestamping Function: Babylon uses the Bitcoin blockchain as a secure and immutable timestamping service. This function ensures that each transaction or block in a PoS chain can be irrefutably verified against a timestamp recorded on the Bitcoin blockchain. This mechanism provides a historical record and prevents the possibility of rewriting the chain.

Separately, Babylon leverages Bitcoin as an asset for economic security. This aspect involves using Bitcoin’s market value as a form of collateral or staking in the PoS chains. Validators or participants in the PoS chains can stake Bitcoin as a guarantee of their honest participation in the consensus process.

This modular approach allows Babylon to optimally utilize Bitcoin’s inherent capabilities:

Data integrity and a synchronized timeline across multiple chains. This approach circumvents the need to engage Bitcoin’s transaction processing capacity for consensus or validation purposes in PoS chains.

Economic value of Bitcoin harnessed for staking and collateral purposes. This strategy leverages the widespread trust and value of Bitcoin to secure the PoS networks without the need for Bitcoin’s direct participation in their consensus mechanisms.

Babylon’s Bitcoin Staking is a Two-Sided Marketplace

The control plane facilitated by Babylon Chain creates a two-sided marketplace that matches the complementary needs of Bitcoin holders and PoS blockchains:

Demand Side - PoS Chains PoS ecosystems require robust security to protect integrity and prevent attacks like transaction censorship or rewrite of historical states. By leveraging Bitcoin's superior security properties, PoS chains can fulfill this demand. They pay usage fees in their native token for Babylon's security services.

Supply Side - Bitcoin Holders Bitcoin holders have an abundance of crypto wealth but limited avenues to productively deploy this for yield generation while retaining exposure to BTC. Babylon's staking protocol unlocks yields for Bitcoin holders by directing their BTC to secure and validate PoS chains as collateral.

Babylon’s control plane thus efficiently matches demand and supply between both sides:

For PoS chains, it offers security services backed by BTC's hardness without need for asset transfer or derivatives. These include timestamping, fraud proofs, bridges etc.

For Bitcoin holders, it enables trustlessly deploying BTC to earn yields by validating high quality PoS ecosystems. No third party custodians are involved.

This two-sided model creates a positive flywheel aligning incentives between participants while capturing value.

As more Proof-of-Stake chains integrate Babylon to leverage Bitcoin's hardened security, more fees flow into the platform. These fees fund staking rewards that attract greater amounts of Bitcoin capital into the system as collateral.

In turn, a higher value of aggregated Bitcoin staked means each individual PoS chain enjoys even stronger security guarantees. This leads to higher confidence and further usage by additional PoS networks. This cycle concentrates security where it is most efficient while distributing financial rewards to participants, aligning incentives beautifully across the ecosystem.

Babylon’s Architecture

Babylon's architecture is strategically designed to maximize efficiency, security, and scalability in blockchain operations. This is achieved through a distinct three-layered approach, each serving a specific function within the ecosystem. Babylon's primary technological innovation lies in its unique method of aggregating and transmitting checkpoint data from various Proof-of-Stake (PoS) chains to the Bitcoin network.

This process involves the following key steps:

Data Collection (from data plane): Babylon collects block data from multiple PoS chains, including block headers and transaction hashes.

Aggregation Mechanism (from control plane): This data is aggregated into a single, compact form. This aggregation minimizes the data footprint, addressing the block size limitations of Bitcoin.

Transmission to Bitcoin (to security plane): The aggregated data is then transmitted to the Bitcoin network, where it is timestamped and stored. This process leverages the robust security and immutability of the Bitcoin blockchain.

Data Plane: The Foundation of Checkpoint Generation

The Data Plane is the foundational layer of Babylon's architecture, primarily comprising various Proof of Stake (PoS) chains. These chains are responsible for the core activities of blockchain operations, including transaction processing, block generation, and maintaining the blockchain ledger.

In the context of Babylon's architecture, the crucial function of the Data Plane is to generate checkpoint data. These checkpoints are essentially snapshots of the blockchain state at specific intervals. They provide a comprehensive summary of the blockchain's current status, including validated transactions and the latest block information.

The PoS chains in the Data Plane are integrated into the Babylon ecosystem. This integration allows for the seamless transmission of checkpoint data from the PoS chains to the Babylon Chain in the Control Plane. The efficacy of this data transfer is vital for the overall functionality and security of the Babylon system.

Control Plane: The Intermediary and Coordinator

The Control Plane is embodied by the Babylon Chain, a specialized blockchain developed to act as the intermediary in Babylon's architecture. Its primary role is to manage the checkpoint data received from the various PoS chains in the Data Plane.

The Babylon Chain performs the critical function of batching checkpoint data from multiple PoS chains. This process involves aggregating the data into a manageable format and preparing it for transmission to the Security Plane. The efficiency of this batching process directly impacts the scalability and performance of the Babylon system.

Once the checkpoint data is batched, the Babylon Chain relays it to the Bitcoin network in the Security Plane. This relay process ensures that the checkpoint data is securely anchored to the Bitcoin blockchain, leveraging its robust security features.

Security Plane: Leveraging Bitcoin's Blockchain for Enhanced Security

The Security Plane is centered around the Bitcoin blockchain, which serves as the ultimate layer of security in Babylon's architecture. The choice of Bitcoin's blockchain is strategic, given its unparalleled security features, including a vast decentralized network and a high hash rate.

The primary role of the Security Plane is to ensure the security and integrity of the entire Babylon system. By recording the checkpoint data from the Babylon Chain onto the Bitcoin blockchain, the Security Plane provides an immutable and tamper-proof record of the PoS chains' states.

The integration of Bitcoin's blockchain in the Security Plane enhances the trustworthiness and reliability of the entire Babylon ecosystem. It ensures that the PoS chains within the Data Plane are protected against various attacks and vulnerabilities, particularly long-range attacks.

This layered architecture not only enhances the operational capabilities of Babylon but also sets a new standard in cross-chain security and scalability. Building on this architecture adapts to new primitive technological innovation.

Babylon's strategic segmentation into distinct planes represents an architectural breakthrough in enabling cross-chain interoperability. By cleanly separating components into modular layers aligned to specific capabilities, Babylon transcends the limitations of monolithic designs.

This principles-based approach reaches the essence of what each constituent does best: the data plane efficiently processes transactions, the control plane specializes in translation and coordination, while the hardened security plane anchors overall integrity.

The elegance is in the simplicity - rather than reinventing redundancies across planes, Babylon conserves resources for specialization.

If you would like to dive deeper into Babylon, here is their whitepaper.

Market Size and Potential

The total staking market cap already exceeds $87 billion for major networks like Ethereum, Aptos, Sui, Cosmos, and $170 billion for the entire PoS networks. This is projected to continue rapid growth in line with crypto adoption trends.

Ethereum alone represents $60 billion PoS market cap with yearly yields nearing $2 billion. As more activity shifts to PoS chains and staking rates rise with improving user experience, total locked value can exponentially multiply.

The report found that around 66% of the circulating Bitcoin supply, equivalent to 12.26 million BTC, has been completely dormant over the past year without any transactions on-chain. This indicates a staggering amount of BTC that is held long-term but not generating any yield.

While HODLing is often promoted in crypto culture, keeping such vast sums of Bitcoin idle and economically unproductive is inefficient from a broader ecosystem perspective.

Especially as more activity continues shifting to smart contract platforms and applications built on staking-backed consensus models like PoS, there is a pressing need to reinforce assurances and security guarantees for these ecosystems.

Babylon presents an avenue to redirect some of these dormant Bitcoin holdings to serve a crucial purpose - providing security collateral for the emerging world of PoS-based decentralized apps and protocols where reliability directly impacts user trust and adoption.

Considering over 60% of Bitcoin's supply has been inactive on-chain for an entire year, Babylon taps into an underutilized reservoir that can transform economic security models to power the next generation of crypto innovation.

As the industry matures, BTC staking could emulate wrapped asset growth trajectories. Wrapped Bitcoin's market cap already signifies nearly $6 billion bridged onto Ethereum for DeFi - showcasing user appetite. Babylon can attract similar demand. And with programmable BTC positioned to be a dominant asset across all major smart contract networks, Babylon sits centrally at the intersection of this value migration by channeling staked bitcoin specifically into PoS security.

The Team

Babylon's foundation and development are deeply rooted in academic research and technological expertise, particularly in the realm of Bitcoin security. This is evident from the team's origin, which includes co-founders David Tse, Fisher Yu, Sreeram Kannan (founder of EigenLayer), and other collaborators, all of whom contributed to a research paper on Bitcoin security that laid the groundwork for Babylon.

He earned a Bachelor’s degree in Systems Design Engineering from the University of Waterloo in 1989, followed by a Master’s degree and a Ph.D. in Electrical Engineering from the Massachusetts Institute of Technology (MIT) in 1991 and 1994, respectively.

David’s professional tenure at Stanford University is distinguished by his focus on information theory and its diverse applications. His contributions to the field have been recognized with prestigious awards and honors.

Notably, he received the Claude E. Shannon Award in 2017, a highly esteemed accolade in the field of information theory. Furthermore, in 2018, he was elected as a member of the National Academy of Engineering, underscoring his significant contributions to engineering and related fields.

Mingchao (Fisher) Yu (Founding CTO)

Fisher Yu holds a Ph.D. from The Australian National University, where his research centered on network information theory and coding.

His specialization in the development of theory and algorithms is particularly focused on wireless communication, indicating a strong background in complex network systems and communication technologies.

We would like to extend our sincere gratitude to David Tse, Fisher Yu, and the Babylon team for providing their invaluable insights and cooperating throughout our evaluation of Babylon.

We couldn't be more thrilled to partner with Babylon on their journey of bridging the gap between Bitcoin and the extended PoS ecosystem. We foresee immense potential as this unlocks previously siloed liquidity and fortifies assurances for the next primitives of decentralized infrastructure.

We look forward to entering this promising journey together with David and Fisher as partners.

Disclaimer: This content is provided for informational purposes only and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisors as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services.