From Peer-to-Peer to Art and Identity

Bitcoin’s Journey with Inscriptions and Ordinals

tl;dr

Overview of Inscriptions and Bitcoin Ordinals:

Inscriptions allow the embedding of arbitrary data directly into Bitcoin transactions using the unused space in the witness field.

Examples of inscribable data include images, text, audio, video files, and more, opening up numerous possibilities for digital ownership and asset creation.

Bitcoin Ordinals:

Bitcoin Ordinals are unique digital artifacts created on the Bitcoin blockchain, offering a method for numbering and identifying individual satoshis.

This transforms them into unique and trackable assets, akin to NFTs, with the protocol introduced in January 2023.

The Ordinals protocol enables the inscription of arbitrary data into the blockchain, leveraging the witness field of Bitcoin transactions.

Practical Implementation and Use Cases:

The process of creating inscriptions and Ordinals involves generating UTXOs, creating commit and reveal transactions, and embedding data into the witness field.

Inscriptions and Ordinals open up various use cases, including digital collectibles, decentralized identity, document timestamping, and more.

Technical Frameworks and Upgrades:

The article delves into the technical aspects, highlighting the Taproot and SegWit upgrades as crucial for implementing inscriptions and Ordinals.

Taproot enhances transaction privacy, flexibility, and efficiency, introducing Schnorr signatures and Pay-to-Taproot (P2TR) addresses.

SegWit addresses transaction malleability issues and improves transaction throughput by segregating signature data.

Metrics, Adoption, and Market Trends:

Over $58 million has been spent on inscription fees, highlighting the substantial activity and value in the space.

There is a growing number of platforms supporting Ordinals, indicating increasing adoption and interest.

This week, we wanted to dive deep into the chain that started it all-- Bitcoin. The L1 landscape is rapidly changing, and Bitcoin, the foundational pillar of the blockchain universe, is evolving to keep up with its alts, such as Ethereum, Solana, and other altcoins, venturing into the realms of inscriptions (similar to tokenization) and ordinals (similar to NFTs).

Bitcoin is stepping up its game to remain at the forefront. With inscriptions and ordinals, it opens up new avenues of innovation, proving that it can do more than just transfer value. This is a critical conversation for everyone in the Layer 1 ecosystem, underscoring Bitcoin's capacity for resilience and innovation.

In this article, we’ll first dissect inscriptions, exploring their nature and the data they can hold. We’ll then delve into the technicalities of Bitcoin inscriptions and their applications-- Bitcoin Ordinals, unraveling their intricacies, the technical frameworks supporting them, and their real-world implications.

With over 35 million inscriptions and counting, Ordinals are slowly becoming a prominent feature on the Bitcoin network, introducing a whole new realm of digital ownership. This seismic shift necessitates a critical examination.

Introduction

Inscriptions refer to the process of embedding arbitrary data into Bitcoin transactions by leveraging the unused space in the witness field. "Arbitrary" means any type of data can be inscribed rather than just predefined types of information. The user can choose whatever data they want to embed into the blockchain using the inscription process.

Some examples of arbitrary data include:

Images (JPEG, PNG, GIF, etc.)

Text or documents (JSON, PDF, etc.)

Audio files (MP3, WAV, etc.)

Video files (AVI, MP4, etc.)

3D models (GLTF)

Hashes or digital signatures

Structured data (JSON, XML)

Addresses, usernames, domains

Program code

Below, you can compare the difference between Inscriptions (in Bitcoin) and Tokenization (on other chains- L1s and L2s)

Technical Framework:

Inscriptions are facilitated within the witness field of SegWit-based Bitcoin transactions. Initially intended for signature data, this field has the capacity to store additional non-signature data.

The maximum weight of a Bitcoin block is 4 million weight units (4MB). However, the actual space available for inscriptions within a single transaction or block may be less due to other data and transaction overhead.

1 million units = 1 MB.

Procedure:

To create an inscription, a user first generates an unspent transaction output (UTXO). Following this, a commit transaction is created that encodes a hash of the data. Subsequently, a reveal transaction is formed that unveils the actual plaintext data in the witness field.

Once mined, the reveal transaction anchors the data into Bitcoin's immutable ledger, enabling provable ownership and timestamping of the inscribed content.

Use Cases: Inscriptions broaden Bitcoin's utility to encompass digital collectibles, document timestamping, decentralized identity, token metadata, and uncensorable publishing of data.

Privacy, Legal, and Ethical Implications: Privacy concerns arise as inscribed data is publicly visible. Users should exercise caution with sensitive information and adhere to standardized encoding schemes to ensure reliable decoding and interpretation. Legal and ethical implications, especially concerning illegal or copyright-violating data, necessitate a mindful approach to what is inscribed on the blockchain.

Cost Implications: Inscriptions incur transaction fees based on the prevailing Bitcoin network rates at the time, and costs may vary depending on the network's congestion.

What makes inscriptions valuable is the limited supply of Bitcoin and its smallest denomination, Satoshi (similar to gwei in ETH). The earlier you inscribe your data into a satoshi, the more valuable it is. It is that straightforward. The fan following around Bitcoin gives Inscriptions more monetary value when it comes to assets that can be owned by holders, which is the same for the Bitcoin you would want to hold, which was mined earlier than the rest.

We will discuss in detail the application of Inscriptions with the example of Ordinals while diving deep into the concepts of Ordinal theory, Taproot upgrade, SegWit, and the importance of UTXOs.

What are Bitcoin Ordinals?

Bitcoin Ordinals are a new type of digital artifact that can be created on the Bitcoin blockchain.

Ordinals are a method for numbering, identifying, and inscribing information on individual satoshis, transforming them into NFTs. Each satoshi, being the smallest unit of Bitcoin, can be uniquely identified and inscribed with information through the Ordinals protocol.

Ordinals are similar to NFTs we see on other L1s and L2s. But rather than creating a different token standard for NFTs (ERC-721, ERC-1155), Ordinals are inscribed directly on the Bitcoin blockchain through inscription.

Ex-Bitcoin core developer Casey Rodarmor introduced the term "Ordinals" and the technology for creating them in the Ordinal Theory. This new type of digital asset has been recognized as a novel way to deploy NFTs directly on the Bitcoin blockchain, and it was unveiled in January 2023.

Ordinals allow users to inscribe arbitrary data into the blockchain by encoding it into the witness field of Bitcoin transactions. The witness field was initially meant to enable new Bitcoin upgrades like SegWit. Developers realized data could be stored in this unused space, giving birth to Ordinals.

The process involves making a small Bitcoin payment to yourself to generate an unspent transaction output (UTXO). The client then uses the UTXO to create two transactions:

The commit transaction stores the hash of the data, locking up the UTXO.

The reveal transaction then unveils the actual data.

In Bitcoin, transaction outputs are used to send payments to addresses. When an output is used as an input in a new transaction, it is considered spent. However, until that output is spent, it remains in an "unspent" state, hence the term Unspent Transaction Output (UTXO).

UTXOs are integral to the process of creating Bitcoin Ordinals. To inscribe data on the blockchain, a user first needs to generate some UTXOs that can be used to make the special transactions for committing and revealing ordinal inscriptions.

This is done by simply sending a small amount of Bitcoin to oneself. For example, sending 0.0001 BTC to a wallet address you control creates a 0.0001 BTC UTXO at that address.

This UTXO can then be used as an input for the first transaction - the commit transaction. The commit locks up the UTXO by encoding a hash of the inscribed data.

Once the commit transaction is mined, the initial UTXO is now spent. A new UTXO representing the locked-up commit output is created.

This new UTXO can then be spent by a reveal transaction that discloses the actual inscribed data in the witness field, completing the Ordinal creation process.

Novel new UTXOs are required to start the process of committing and revealing inscriptions on the blockchain. The UTXOs transition from an unspent state to a spent state as they get consumed by the sequence of transactions to create the Ordinal.

The concept of inscriptions and ordinals was first proposed by Casey Rodarmor in November 2021, shortly after the activation of the Taproot upgrade on Bitcoin. Taproot introduced a new scheme called Schnorr signatures (discussed further), enabling more efficient and flexible transactions on Bitcoin. Taproot also made it possible to store more data in the witness part of a transaction, where inscriptions are written.

The motivation behind inscriptions and ordinals was to expand the design space for Bitcoin and create new use cases beyond the simple transfer of value. Rodarmor envisioned inscriptions as a way of creating digital carvings on Bitcoin, similar to how ancient civilizations carved messages on stone tablets or coins. He also saw ordinals as a way of making each satoshi unique and identifiable, similar to how serial numbers are used for banknotes or collectibles. Once revealed onchain, the data is permanently embedded into Bitcoin's ledger. This enables several use cases:

Digital Collectibles: Artists can mint non-fungible tokens (NFTs) by inscribing images, audio or other multimedia files. These create scarce digital artifacts.

OnChain Identity: Users can create decentralized identifiers by inscribing public keys or domain names. These IDs don't rely on accounts.

Timestamping: Documents can be inscribed to prove their existence at a point in time. This leverages Bitcoin's immutable ledger.

Digital Shares: Tokens can be issued on Bitcoin without smart contracts using simple text inscriptions.

The creation and management of Ordinals are facilitated through the Taproot upgrade (discussed further) on the Bitcoin network, which allows for the inscription of data on a satoshi, making Ordinals similar to NFTs but not limited by Bitcoin's block size limit.

We’ve outlined here a step-by-step explanation detailing the process of creating an inscription on the Bitcoin blockchain:

1. Generate a new Bitcoin address to receive some Bitcoin into. This will create a fresh unspent transaction output (UTXO) that can be used to make the inscription transactions.

2. Send a small amount of bitcoin, like 0.0001 BTC, to the above address. This will create a UTXO of 0.0001 BTC at that address.

3. Prepare the data to be inscribed. The data can be in any format, like text, image, audio, video, etc. Encode the data into a hex string using an encoding scheme like Base64.

4. Import the UTXO and private key for the address into the inscription software wallet, like the Ordinals Client.

5. In the wallet, create a commit transaction. This locks up the UTXO by storing the hash of the encoded data in the OP_RETURN output. Broadcast this transaction to the Bitcoin network.

6. Once the commit transaction is confirmed, the UTXO is now locked up. Now create a reveal transaction spending this UTXO.

7. In the reveal transaction, provide the actual plaintext encoded data in the witness field. Broadcast this to the network.

8. When the reveal transaction is confirmed, the data is permanently embedded into the Bitcoin blockchain at that transaction position.

9. Search for the transaction ID on a block explorer to verify the inscription and view the inscribed data.

The above steps are how you do it manually. Fortunately, we do have several platforms that let you inscribe data into Bitcoin without needing to do any of the above manually—for example, Gamma and BTC.com.

What is the Ordinal Theory?

Ordinal Theory is a foundational concept for the operation and understanding of Bitcoin Ordinals.

Core Principle: Ordinal Theory posits a methodology for individually identifying and tracking each satoshi (the smallest unit of Bitcoin) throughout its supply chain. It assigns a unique serial number to each satoshi based on the order in which they are mined and transferred in transactions.

Unique Identification and Tracking: The theory aims to provide individual identities to each satoshi, allowing them to be tracked and transferred with unique meanings through "inscriptions." These inscriptions are digital assets akin to NFTs (Non-Fungible Tokens), inscribed on a satoshi within the Bitcoin network.

Serialization and Inscriptions: Ordinal Theory delineates how to serialize and track satoshis. Once serialized, these satoshis are referred to as "ordinals." Data chunks known as "inscriptions" can then be associated with these ordinals, effectively creating a form of NFT on Bitcoin. This simple concept has a complex implementation in the client that runs ordinals.

Development: It's realized through the Ordinals protocol, which enables the unique, ordered numerical identification of each satoshi on the Bitcoin blockchain. This unique numbering allows for the individual tracking and transferring of satoshis.

Implementation: The implementation of Ordinal Theory was facilitated by the Taproot upgrade on the Bitcoin network, launched on November 14, 2021. This upgrade enabled the inscription of data on individual satoshis without the need for a sidechain, thus underpinning the identification and tracking of each satoshi from the moment of mining through its entire transaction lifespan.

In essence, Ordinal Theory expands the utility of Bitcoin by enabling the creation of non-fungible assets on its blockchain, akin to how NFTs operate on other blockchain networks like Ethereum. Through the Ordinals protocol, individual satoshis can carry unique identities and inscriptions, paving the way for a myriad of use cases, including digital collectibles and verifiable asset ownership on the Bitcoin network.

The first known Bitcoin Ordinal was created in December 2022 by developer Casey Rodarmor, credited with pioneering the Ordinals protocol. This inaugural Ordinal was a pixel art skull, nicknamed the "Rodamar Bitcoin Ordinal," minted on the OpenSea marketplace.

What Specific Frameworks Enabled Ordinals?

The inception of Bitcoin Ordinals was significantly facilitated by the strategic advancements brought about by the Taproot and SegWit protocol upgrades on the Bitcoin network. These upgrades instilled crucial features that broadened Bitcoin's functionalities, paving the way for the creation and seamless operation of Bitcoin Ordinals.

Let’s explore each in detail.

Taproot Upgrade

The Taproot upgrade, activated on November 12, 2021, at block 709,632, is a paramount enhancement to the Bitcoin protocol that aims at bolstering the privacy, flexibility, and efficiency of transactions on the network. This upgrade is the first of its kind since the activation of Segregated Witness (SegWit) in 2017.

The Taproot upgrade comprises three interconnected Bitcoin Improvement Proposals (BIPs) that were deployed simultaneously:

BIP 340 (Schnorr): Introduces Schnorr signatures, a digital signature scheme known for its speed, security, and data efficiency compared to the existing Elliptic Curve Digital Signature Algorithm (ECDSA).

BIP 341 (Taproot): Defines Pay-to-Taproot (P2TR), a novel method to transact Bitcoin that augments privacy and flexibility for users. It also integrates Merklized Alternative Script Trees (MAST) to compress multifaceted Bitcoin transactions into a single hash, consequently reducing transaction fees, minimizing memory usage, and enhancing Bitcoin’s scalability.

BIP 342 (Tapscript): Proposes Tapscript, an updated version of Bitcoin’s original scripting language that facilitates P2TR transactions, leverages the efficiency of Schnorr signatures, and allows for more flexible upgrades in the future.

The Taproot upgrade achieved a 90% consensus among miners on June 12, 2021, which locked in its November activation as a soft fork to Bitcoin's protocol. Being a soft fork, Taproot is backward compatible with older versions of Bitcoin and doesn't create a separate, parallel blockchain. The adoption of Taproot was anticipated to evolve gradually over several years, akin to the adoption trajectory of SegWit.

Taproot plays a pivotal role in allowing the inscription of arbitrary data onto the Bitcoin blockchain to generate Ordinals. It provides two key innovations:

Pay-to-Taproot (P2TR) addresses: P2TRs allow complex spending conditions and scripts to be encoded into a single public key. This hidden complexity under one key is leveraged to embed the data that constitutes an Ordinal’s inscription.

Schnorr signatures: These digital signature schemes offer greater privacy by aggregating multiple signatures into one. This masking of complexity aids in obscuring Ordinal inscription transactions.

Pay-to-Taproot (P2TR) is a new type of Bitcoin address introduced by the Taproot network upgrade in 2021. P2TR addresses provide enhanced privacy, flexibility, and scalability compared to original Bitcoin addresses. P2TR addresses start with bc1p and utilize a version 1 Taproot output. This allows them to leverage Taproot's Schnorr signature scheme and Merklized Abstract Syntax Tree (MAST) structure.

A key innovation in P2TR is that a complex Merklized script tree can be embedded in the address itself, hidden behind a single public key. This script encodes the conditions that must be satisfied to spend funds sent to the address.

For example, a P2TR address may contain a multisig setup requiring 2 out of 3 private keys to sign and spend funds. But on the blockchain, it appears identically to a regular address with only one public key.

When funds are spent from a P2TR address, only the exact conditions that were satisfied in the transaction are revealed. The other possible conditions remain hidden, enhancing privacy.

This is unlike original Bitcoin addresses, where complex scripts were fully revealed, creating transparent links between keys and conditions. P2TR addresses mask all this complexity. P2TR addresses and Schnorr signatures enable the construction of specialized inscription transactions that privately and efficiently anchor user-defined data into Bitcoin’s immutable ledger.

Without the Taproot upgrade, Bitcoin would lack the transaction flexibility and privacy required to embed extraneous data seamlessly. Taproot’s extensions to Bitcoin’s scripting capabilities are essential for the existence of Ordinals.

Note:

Merklized Abstract Syntax Trees (MAST)

Allow complex conditions and scripts to be attached to Bitcoin transactions.

The conditions are arranged in a tree structure and hashed.

Only the conditions needed to spend the funds are revealed; others remain hidden.

This improves privacy and reduces data size on the blockchain.

Schnorr signatures:

A digital signature scheme that enables "signature aggregation."

Multiple signatures can be combined into one single signature.

This makes complex multisig transactions appear simple on the blockchain.

Reduces data size and provides more privacy versus Bitcoin's original signature scheme.

Allows new multisig schemes and smart contracts to be developed more efficiently.

MAST enables efficient and private complex scripts, while Schnorr signatures aggregate signatures to mask complexity and reduce data. Together, they enhance Bitcoin's capabilities for advanced transactions.

Segregated Witness

SegWit, short for Segregated Witness, is a significant protocol upgrade activated on the Bitcoin network in August 2017, aimed at resolving the issue of transaction malleability and enabling greater transaction throughput. The essence of SegWit is the separation of transaction signature data from the rest of the transaction data. Signatures are relocated to a new structure known as the witness, which fundamentally alters how transactions are organized and validated.

In the pre-SegWit arrangement, signatures were part of the same structure that contained the sender/receiver and amount data. This configuration was prone to transaction malleability, where signatures could be altered post-transaction initiation, potentially invalidating transactions.

SegWit addresses malleability by segregating signatures into a distinct witness structure. This segregation is instrumental in enabling advanced functionalities like the Lightning Network, which necessitates reliable transaction identifiers.

Furthermore, SegWit introduces a discounting mechanism for signature data when calculating the size of a transaction. Each byte of signature data is counted as 0.25 bytes against the 1 MB block size limit. This effectively augments the number of transactions that can fit into a block, thereby enhancing Bitcoin's scalability. (Check Appendix (AP #1) for a detailed explanation)

In the SegWit design, a new structure devoid of signature data called the transaction hash, is propagated across the network, reducing bandwidth requirements. Contrary to the previous understanding, the actual witness data containing signatures is shared with all nodes once a block is mined, not just the parties directly involved in a transaction. This sharing is crucial for full nodes to validate transactions, maintaining the network's integrity and security.

SegWit ensures backward compatibility with non-upgraded legacy Bitcoin software. To these legacy systems, SegWit transactions appear valid as all necessary data is still present, ensuring a smooth transition during the upgrade.

While not as directly instrumental as Taproot, SegWit delivers optimizations that assist in the scalability and efficiency of Ordinals:

Witness data segregation: By separating signature data, SegWit created the witness field that is leveraged to store inscription data in Ordinals.

Scalability: SegWit’s fixes to transaction malleability allow more transactions to fit in each block. This improves throughput for all transactions, including Ordinal inscriptions.

Efficiency: Removing signatures from the original transaction structure results in weight savings that lower fees. This enhances the efficiency of embedding Ordinal data on-chain.

Hence, as discussed above, Taproot’s programming flexibility is a prerequisite for Ordinals, while SegWit provides supplementary scaling and efficiency gains that likely aid their adoption and growth. Together, these two key upgrades enabled the innovation of provably embedding customizable user data natively into Bitcoin.

The SegWit and Taproot upgrades collectively fostered a technical architecture conducive to the innovation and operation of Bitcoin Ordinals. These upgrades expanded Bitcoin's utility beyond mere payments. They established a fertile ground for developing advanced applications, such as Bitcoin Ordinals, thereby propelling Bitcoin's evolution towards becoming a versatile, decentralized platform for a myriad of financial and non-financial applications.

Some metrics to look at for Ordinals and Inscriptions on Bitcoin:

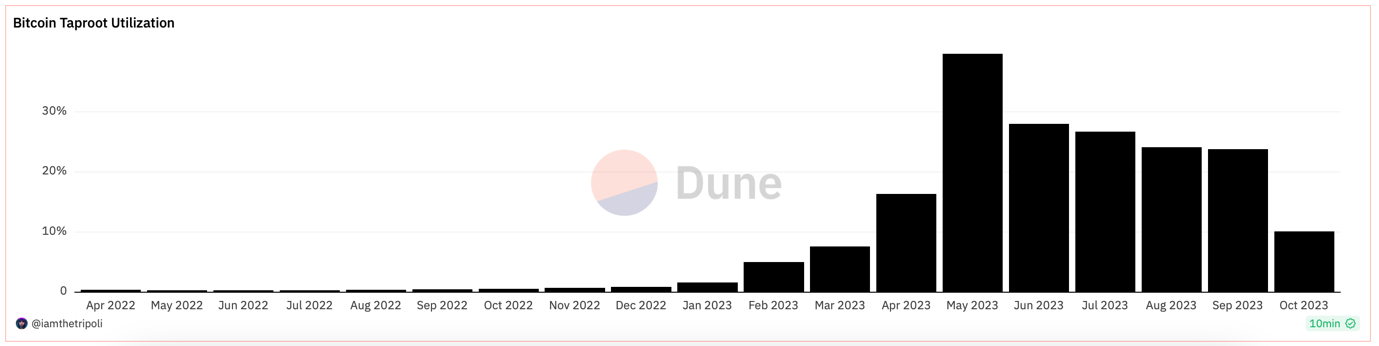

Bitcoin Taproot Utilization: This measures how many transactions on the Bitcoin network use the Taproot upgrade, which is a new way of verifying and securing transactions. Taproot makes transactions faster, cheaper, and more private by combining multiple signatures and inputs into one.

It is worth noting that the Taproot upgrade is more beneficial for complex transactions that involve multiple parties, conditions, or contracts, such as ordinal collections, multisig wallets, or smart contracts. Simple transactions involving only sending and receiving bitcoins may see little difference or improvement using Taproot.

From early 2023, we saw many exchanges and wallets support Ordinals on their platforms. It first started with Gamma, who provided a market for Ordinals to be listed and created within their platform (the first to do so). This followed Opensea and Magic Eden to follow the trend and support Bitcoin Ordinals and Stacks NFTs onto their platform. Hence, you can see the increased engagement from February 2023 onwards.

Daily fee spending on Inscriptions: The daily fee spending on Inscriptions has fallen from ~$180k in September to ~$23k as of October.

The overall crypto/NFT market has seen lower general interest and demand throughout late last year and the whole of this year. Many early Ordinals users may have been speculators attracted to the hype and potential profits, as we see with any digital asset class, the traction and attention it gets over time. As prices decline, speculators lose interest. The remaining users are more likely true believers and collectors.

As we explained earlier how the inscription process works in the Bitcoin blockchain, we believe there might be some technical bottlenecks and limitations around Bitcoin transaction throughput that may be constraining Ordinals capacity and adoption. This also manifests in fewer new collections launching, reducing transaction volumes.

However, all-time fees spent on inscriptions have reached $58 million.

There is no doubt that in the long run, there is a significant demand and activity around holding Bitcoin and creating inscriptions on the Bitcoin blockchain. A high volume of inscription transactions must be occurring to accumulate such high fees. Users see enough value in creating and owning inscriptions that they are willing to pay substantial fees. This indicates inscriptions are providing practical utility beyond just novelty.

The fees spent likely represent only a fraction of the total value of the inscribed assets. Users, both retail and institutional, are paying fees to create assets worth much more. This is also mainly driven by the scarce supply of Bitcoin, and having inscriptions imprinted as early in the blocks makes more engagement plausible.

Speculation and investor interest likely account for some of the inscription activity and fees, but not all. There is a real underlying demand. Bitcoin's valuation and price may need to account for new sources of fee revenue like inscriptions, not just payment-related usage. Overall, the scale of fees spent ($58M) highlights that inscriptions on Bitcoin have crossed over into a real market with tangible value, not just experimental.

Conclusion

When you take a step back, it's incredible how far Bitcoin has come since the Genesis block on January 3rd, 2009. What started as a peer-to-peer payment network has evolved into so much more - a decentralized platform for creativity, ownership, and expression. With the advent of Ordinals, we're witnessing this next evolution unfold. For the first time, Bitcoin's robust architecture is being leveraged not just to transmit value but to permanently embed data and digitally "engrave" artifacts.

No funky workarounds like sidechains or token contracts are needed. The transactions themselves now double as a public ledger for provable digital ownership. A simple yet profound innovation.

Of course, we can thank upgrades like Taproot and SegWit that set the stage by bolstering Bitcoin's capabilities. But Ordinals take it to the next level. Suddenly, satoshis can represent not just monetary value but history, identity, or creative expression.

And judging by the millions in fees spent already, it turns out there's quite the demand for this functionality. Speculators jumped in early, as they always do. But beneath the hype is real, tangible value in being able to publicly imprint information.

The journey continues; buckle up.

Appendix

AP #1

Before SegWit, all parts of a transaction were counted equally towards this block size limit. However, SegWit introduced a new concept known as "block weight," which is a more complex measure of the size of a transaction aimed at providing a discount for the witness data (which contains the signatures).

Breakdown of how this discounting works:

Block Weight Calculation:

With SegWit, the size of a transaction is calculated as the sum of the size of non-witness data (i.e., the original transaction data without the signatures) plus the size of the witness data (i.e., the signatures) multiplied by a factor of four.

Mathematically, this is expressed as: Transaction weight = (non-witness data size) + (witness data size * 4)

1 million units = 1 MB

Signature Data Discount:

This calculation effectively means that each byte of witness data (signature data) is counted as 0.25 bytes towards the block size limit, as opposed to 1 byte under the old system.

The factor of four in the formula gives a 75% discount to the witness data.

Block Size Limit Adjustment:

SegWit also replaced the 1 million weight unit block size limit with a 4 million weight unit (4MB) block weight limit. This adjustment allows for blocks larger than 1 million weight units, but they still adhere to the effective discounting of witness data.

Increased Capacity:

By discounting the size of the witness data, more transactions can fit into a single block. This effectively increases the block size without requiring a hard fork to change the block size limit.

Encouragement of Witness Data Usage:

This discount also incentivizes using the SegWit transaction format, making transactions with segregated witness data more cost-effective in terms of transaction fees.

Transaction Fee Implication:

Transaction fees in the Bitcoin network are often calculated based on the transaction size. Since SegWit transactions have a discounted size, they may also enjoy lower transaction fees than non-SegWit transactions.

Find L2IV at l2iterative.com and on Twitter @l2iterative

Author: Arhat Bhagwatkar, Research Analyst, L2IV (@0xArhat)

References:

Disclaimer: This content is provided for informational purposes only and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisors as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services.

Not many VCs have published an article exploring Ordinals nd its good to see you guys doing it!!

Some questions:

1. with the step by step process of creating inscriptions, does the format of the data change? If so, then how?

2. are you guys also investing in startups in bitcoin eocystem?