tl;dr

In 1869, Dmitri Mendeleev published what would become one of the most iconic scientific classifications - the periodic table of chemical elements. By systematically organizing the known elemental building blocks of matter based on shared properties, Mendeleev’s framework revealed relationships between substances that spawned breakthroughs for generations. The periodic table fundamentally changed how scientists conceptualized material composition and creation through deconstruction and structured reconfiguration.

Today, in DeFi, we stand at the cusp of a similar primitive in understanding cryptoasset architectures. The Cambrian explosion of novel DeFi designs has left infrastructure fragmented, isolated, and impossible to integrate.

The modular design inherent in the periodic table revolutionized material sciences. It allowed for the deconstruction and reconstruction of materials by combining basic elements in myriad configurations, sparking an era of unprecedented material innovation. A similar "Lego" style modularity is evident in the DeFi sector with the advent of ERC-4626 tokenized vault interfaces.

ERC-4626 accomplishes a similar classification (to periodic table) for tokenized asset vaults - a base money Lego underpinning DeFi composability. Vaults allow pooled capital deployment towards managed yield-generating strategies with the proportional token distribution. By framing vaulted assets as modular components with reliable interfacing properties instead of one-off integrations, the standard enables permissionless innovation via contextual composition.

Yet vault mechanisms differed across protocols - inhibiting interoperability due to disparate accounting, deposit paradigms, and data access conventions.

Classifying vault interactions paves the way for structured derivatives, stacking aggregators, and sandboxed experimentation with predictable baseline behaviors. The enumerated specification lends confidence for external contract reliance, laying the bedrock for an explosion of financial metastructures. It future-proofs ecosystem evolution while accelerating it by reducing duplication. Most importantly, it shifts the paradigm from competition to specialization - each vault is sovereign yet cooperative.

The token vault specification transforms these yield containers into money Lego compatibility, now stackable and linkable in modular configurations, opening new compositional possibilities. Vault strategies specialize, while vault access generalizes.

In this article, we dive deep into topics like:

Core functionality facilitating cross-chain interoperability

Architecture and implementation best practices

Use cases across lending, structured products, tokenized staking, and beyond

Assessing risks - technical pitfalls to sustainability concerns

By framing issues and opportunities around this financial base layer standard, we chart a roadmap towards increased capital efficiency and permissionless innovation anchored on principles of access over exclusivity.

So, just as elemental commonality produced combinatorial chemistry, componentizing vault behaviors fosters emergent crypto-financial primitive. Aggregated fundamentals merge with permissionless creativity unencumbered. The vault interface standard may catalyze DeFi’s very own “periodic table” moment - ushering order amongst chaos.

Introduction

ERC-4626 is an Ethereum standard that provides a framework for tokenized vaults, specifically focusing on vaults that handle a single underlying ERC-20 token. This standard is significant in DeFi as it seeks to establish a uniform interface and set of functionalities for these vaults, thereby enhancing compatibility and interoperability across various DeFi applications.

Core Concept

At its core, ERC-4626 defines a standard API for tokenized vaults. These vaults are essentially smart contracts that manage a specific underlying ERC-20 token. The vault issues its own tokens, referred to as shares, which represent an ownership stake in the vault's assets. For example, depositing 100 units of an ERC-20 token into a vault might issue 10 shares, indicating the depositor's claim over a portion of the vault's holdings.

Key Functionalities

The standard mandates several key functionalities to be implemented by any ERC-4626-compliant vault:

Deposits and Withdrawals: Users can deposit and withdraw the underlying ERC-20 token into the vault. Users who deposit tokens receive a proportional number of shares in return. Conversely, when withdrawing, they redeem these shares for a corresponding amount of the underlying token.

Conversion Between Assets and Shares: ERC-4626 provides methods to determine how many shares a given amount of the underlying asset is worth and vice versa. This conversion is crucial for understanding the value of shares regarding the underlying asset.

Viewing Total Assets and Shares: The standard includes functions to view the total amount of the underlying asset managed by the vault and the total supply of shares. This transparency is vital for users to understand the scale and scope of the vault's holdings.

Handling Fees and Slippage: The standard acknowledges the possibility of fees charged by the vault for various services and the concept of slippage – the difference between expected and actual share prices due to on-chain conditions.

Implementation Details

ERC-4626 vaults must implement the ERC-20 standard for their shares, making them compatible with the broader ecosystem of wallets, exchanges, and other services supporting ERC-20 tokens. This implementation detail ensures that the shares themselves are as widely usable as possible. Moreover, the standard allows for optional implementation of EIP-2612, which can improve user experience regarding share approvals. This addition is particularly useful when users need to permit other smart contracts to spend their shares.

Why are we talking about ERC-4626?

ERC-20, ERC-721, and ERC-1155: Functions and Limitations

The ERC-20 standard defines fungible, interchangeable tokens such as stablecoins, governance tokens, or staking derivatives. It outlines key functionalities like transferring, approving, and querying balances. Limitations include a lack of built-in royalties or caps on token minting.

ERC-721 handles non-fungible tokens with unique metadata like digital art and collectibles. It allows enumerating an owner's assets and transferring NFTs between parties. However, aggregating holdings across wallets or assessing portfolio value can be complex.

ERC-1155 amalgamates aspects of both standards into multi-token contracts handling fungible, non-fungible, and semi-fungible token types. However, verifying the authenticity of new NFTs minted under existing contracts is challenging.

Transition to Complex Financial Interactions in DeFi

Early DeFi focused on basic lending protocols allowing crypto-collateralized borrowing and margin trading. Platform feature sets were simple - supply assets, borrow assets. However, rapid yield farming innovation led to new compositional opportunities. Smart developers began creatively stacking discrete lending, swapping, liquidity, and derivative modules into sophisticated strategies like automated yield optimization. This "money Lego" architecture produces emergent behaviors not anticipated by individual protocol designers. Users seek ever more advanced orchestrations across isolated systems, seeking margin advantages.

Interactions in DeFi are now multifaceted, but backend systems remain fragmented. Unique yield vault architectures, bespoke reward token distribution schemes, and custom accounting systems inhibit seamless cross-platform interoperation. This manifests when smart contract developers spend time rebuilding redundant integrations repeatedly.

Even though it's been a few years, ERC-4626 solves this by standardizing vault interactions and accounting under a consistent interface. Frontends can abstract away backend implementation details, and architects can mix-and-match vaults in creative combinations. Standard interfaces remove needless friction and accelerate compositional innovation: the result is faster, safer, and more varied financial opportunities for end users.

Extending ERC-20 for Vault Shares/Tokens

The ERC-4626 specification extends the ERC-20 fungible token standard to represent vault shares. By depositing assets into a compliant vault contract, users receive ERC-20 tokens in return, representing fractionalized ownership shares of the vault's holdings.

The amount of tokens minted will correspond to the dollar value or quantity of assets supplied to the vault (based on current exchange rates). As the vault accrues additional yield through compounding interest rates, swap fees, liquidation bonuses, or other protocol revenue streams, these earnings are distributed pro-rata to all vault shareholders in proportion to the number of tokens they hold.

This lets vault tokens function similarly to ETFs in traditional finance – holders are entitled to a slice of profits from the aggregated underlying assets. However, the shares are more versatile since they can be freely traded on AMMs to realize gains, used as productive collateral in lending protocols, staked towards governance rights, bundled with options contracts, and more.

The fungible nature of vault tokens also creates emergent composability.

If lending platform A offers higher interest on token X, while platform B has better rates for token Y, savvy integrators can build cross-chain routing systems that auto-balance asset allocations across vaults to optimize for yield. Traders might leverage derivatives like futures or options that settle based on the value of diversified vault tokens rather than just individual assets.

By encapsulating Yield aggregator strategies with a consistent share token interface, complex opportunities arise from interoperability despite disparate underlying implementations.

As discussed further in the article, the ERC-4626 specification outlines various interfaces that vaults should implement to enable cross-compatibility. These include:

Deposit Function

- Allow users to supply assets to the vault and mint proportional ERC-20 shares in return.

- Parameter for receiving addresses to enable deposits on behalf of other accounts (useful for smart contract wallets and integrators).

Withdraw Function

- Enable redeeming vault shares back for the underlying asset.

- Transfers redeemed assets directly to specified recipient address for flexibility.

CalculateShares Function

- Returns the current exchange rate between vault shares and the underlying asset.

- Critical for accurately pricing vault tokens used in secondary DeFi markets or derivatives.

PreviewWithdraw Function

- Returns the maximum amount of the underlying asset redeemable for a certain number of shares.

- Useful for risk analysis UIs estimating slippage before withdrawal.

Transfer Hooks and Events

- Logs token state changes on-chain for transaction reconciliation.

- Hooks like afterDeposit allows custom interactions with external contracts.

While all implementations share a unifying interface, architectural approaches can still vary significantly in aspects like:

Smart Contract Control: Difference between administrator/owner roles and community-controlled vaults

Custodial vs Non-Custodial: Legal implications around asset recovery and censorship resistance guarantees

Yield Strategy Constraints: Simple passive aggregation vs. dynamic optimization with implications for value stability

When vault tokens are used as productive collateral or inputs to derivative trading, assumptions around these architectural variables can create substantial risk differentials. So, increased transparency from implementers aids in comparative analysis by financial engineers. Over time, open assessment of diverse approaches with a shared interface fuels iterative innovation within the standard to meet application needs. Interoperability enables modular enhancements.

What are the core components of ERC-4626?

Tokenized Vault Structure: The primary concept of ERC-4626 is the tokenized vault, a smart contract that manages a single type of underlying EIP-20 (ERC-20) token. These vaults issue their own tokens, known as shares, which represent a claim on a portion of the vault's assets.

Share Token Standard Compliance: The shares issued by the vault comply with the ERC-20 standard. This compliance ensures broad compatibility with the existing Ethereum ecosystem, including wallets, exchanges, and other smart contracts that interact with ERC-20 tokens.

Asset and Share Conversion Functions: ERC-4626 provides functions to convert between the underlying asset and the vault shares. This includes methods to determine how many shares a certain amount of the underlying asset is worth and vice versa. These conversion functions are essential for users to understand the value of their shares.

Deposit and Withdrawal Mechanisms: The standard includes functionalities for depositing the underlying ERC-20 tokens into the vault and withdrawing them. Deposits result in the issuance of shares to the depositor, while withdrawals involve redeeming these shares for the underlying tokens.

Total Asset and Share Tracking: ERC-4626 mandates functions to track and report the total amount of the underlying asset held by the vault and the total supply of issued shares. This transparency is critical for assessing the vault's scale and performance.

Handling of Fees and Slippage: The standard acknowledges the potential for various types of fees charged by the vault, such as management fees or performance fees, and the concept of slippage, which refers to the difference between expected and actual prices due to market conditions.

Optional EIP-2612 Implementation: While not mandatory, ERC-4626 vaults may implement EIP-2612, which enhances the user experience in terms of share approvals, particularly in scenarios involving permission for other contracts to spend the user's shares.

Security Considerations: The standard highlights the importance of security in vault implementations. While ERC-4626 outlines the interface and expected behaviors, the underlying smart contract logic can vary, necessitating careful review and analysis to ensure security and trustworthiness.

Backward Compatibility: ERC-4626 is designed to be backward compatible with the ERC-20 standard, facilitating integration with existing systems and platforms in the Ethereum ecosystem.

These core components collectively define the ERC-4626 standard, providing a structured and standardized approach to creating and managing tokenized vaults on the Ethereum blockchain. This standardization is aimed at enhancing interoperability, usability, and security within the DeFi landscape.

What about its technical architecture?

The technical architecture of ERC-4626 can be understood by examining its key components and functionalities:

Methods

asset(): Get address of underlying EIP-20 token

totalAssets(): Get total assets managed by vault

convertToShares(): Estimate shares for a deposit amount

convertToAssets(): Estimate assets for a share amount

Deposit/withdraw methods to exchange assets and shares

Preview methods to simulate deposits/withdrawals

Max methods to get deposit/withdraw limits

1. Tokenized Vault Concept

Purpose: ERC-4626 vaults are smart contracts that manage a pool of a single type of ERC-20 token.

Shares Issuance: These vaults issue their own tokens, known as shares, which represent a proportional claim on the vault's assets.

2. ERC-20 Compliance for Shares

Standard Compliance: The shares issued by an ERC-4626 vault comply with the ERC-20 token standard. This ensures compatibility with the broader Ethereum ecosystem.

Share Token Characteristics: Shares have standard ERC-20 functions such as transfer, approve, and balanceOf.

3. Asset Management Functions

Deposits and Withdrawals: Users can deposit the underlying ERC-20 tokens into the vault and withdraw them. These processes involve the issuance or burning of shares.

deposit function: Allows users to deposit the underlying token and receive vault shares.

withdraw function: Enables users to redeem shares for the underlying token.

Conversion Mechanisms: Functions to convert between the underlying asset and shares are provided.

convertToShares: Calculates the number of shares that a given amount of the underlying asset is worth.

convertToAssets: Determines the amount of the underlying asset that a given number of shares represents.

4. Querying Vault State

Total Assets and Shares: Functions to query the total assets managed by the vault and the total supply of shares.

totalAssets: Returns the total amount of the underlying asset managed by the vault.

totalSupply: Standard ERC-20 function, repurposed to reflect the total supply of vault shares.

5. Handling Fees and Slippage

Flexibility for Fee Structures: The standard allows for the implementation of various fee structures, although specifics are left to individual implementations.

Slippage Considerations: Acknowledges the potential for slippage in transactions and provides mechanisms to estimate and account for it.

6. Optional Extensions and Security

EIP-2612 for Permitting: Optional implementation to allow for gasless transactions and improved user experiences.

Security Emphasis: While ERC-4626 defines interfaces and expected behaviors, the underlying contract logic can vary, requiring rigorous security checks.

7. Event Emission

Transparency in Operations: The vault emits standard ERC-20 events for share transfers and can also emit custom events for deposit and withdrawal operations, enhancing transparency and auditability.

8. Backward Compatibility

Integration with Existing Systems: Designed to be backward compatible with ERC-20, enabling integration with current systems and services that support ERC-20 tokens.

9. Interoperability with DeFi Ecosystem

Seamless Integration: The standard design facilitates easy integration with other DeFi protocols, DApps, and services in the Ethereum ecosystem.

Some Key Considerations in Architecture:

Flexibility vs. Standardization: While ERC-4626 standardizes certain aspects of tokenized vaults, it allows flexibility in implementation details, especially regarding fee structures and asset management strategies.

Security and Trust: Given the autonomy and financial implications of smart contracts, security is paramount. The standard encourages but does not enforce specific security practices, leaving room for innovation but also necessitating diligence from developers and users.

User Experience: By aligning with ERC-20 standards and allowing for optional extensions like EIP-2612, ERC-4626 aims to provide a familiar and user-friendly experience.

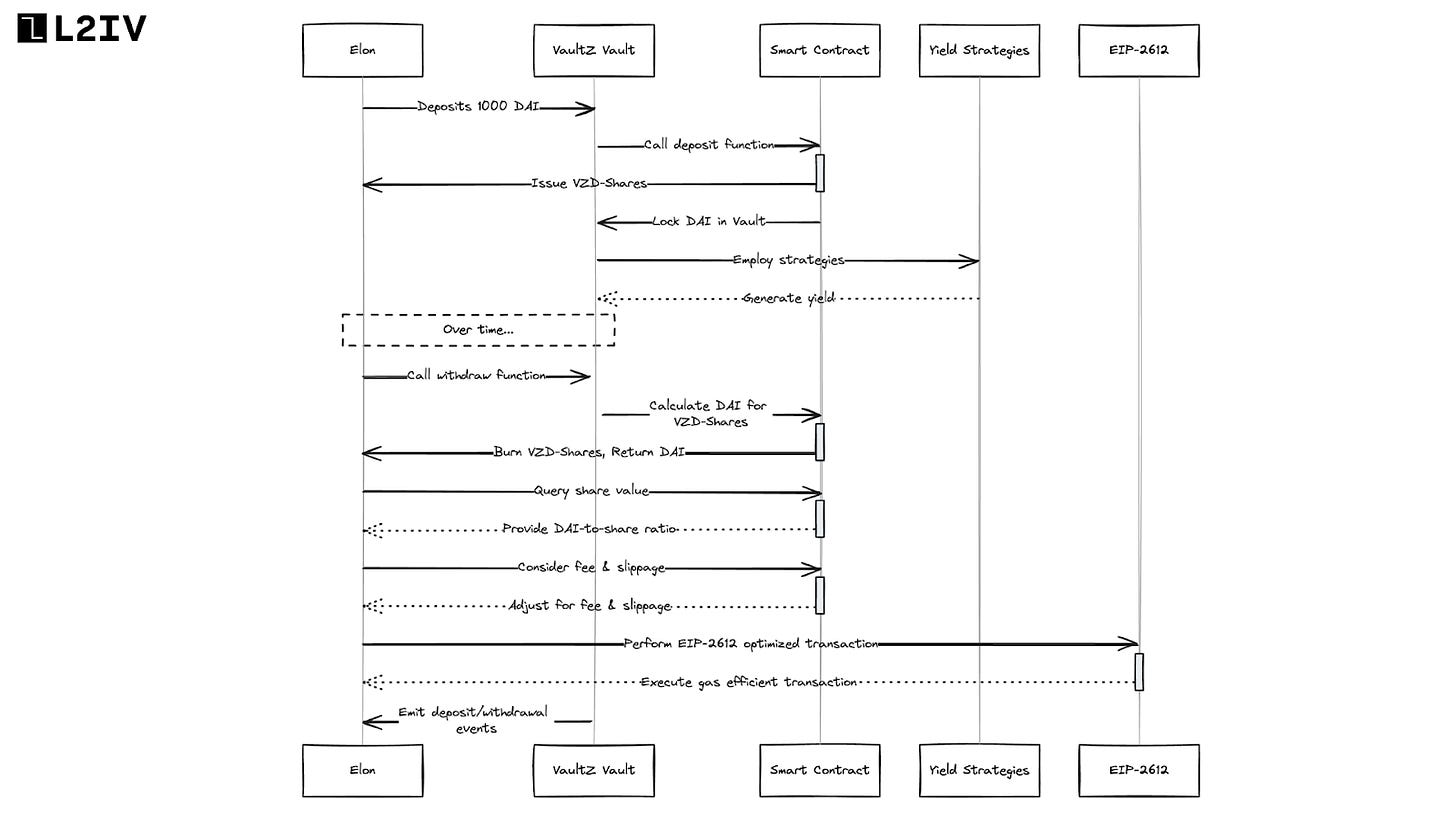

To illustrate the technical architecture of ERC-4626, let's consider a fictional DeFi platform, "VaultZ," which has implemented an ERC-4626 tokenized vault. This vault manages DAI, a stablecoin pegged to the US Dollar.

VaultZ's ERC-4626 DAI Vault

VaultZ offers a vault that users can deposit DAI into, in return for yield-generating opportunities. The vault issues its own shares, called "VZD-Shares," representing a claim on a portion of the vault's DAI holdings.

Step 1: User Interaction - Deposit

User Action: Elon decides to deposit 1000 DAI into the VaultZ Vault.

Smart Contract Process:

Elon calls the deposit function of the vault's smart contract.

The contract calculates the number of VZD-Shares to issue. This is based on the current share price, which is derived from the ratio of the total DAI in the vault to the total VZD-Shares in circulation.

The contract issues the calculated VZD-Shares to Elon's address and locks her DAI in the vault.

Step 2: Vault Operation - Yield Generation

Vault Strategy: The vault employs various strategies (like lending DAI on other DeFi platforms) to generate yield.

Yield Accumulation: Over time, the yield from these strategies accumulates, increasing the total amount of DAI held in the vault.

Step 3: User Interaction - Withdrawal

User Action: After some time, Elon decides to withdraw her funds.

Smart Contract Process:

Elon calls the withdraw function, indicating the number of VZD-Shares she wishes to redeem.

The contract calculates the equivalent amount of DAI based on the current share price.

The contract then burns Elon's VZD-Shares and returns the calculated amount of DAI to her.

Step 4: Share Value Calculation

Conversion Functions: Throughout this process, functions like convertToShares and convertToAssets provide Elon with information on the value of her shares in terms of DAI and vice versa.

Dynamic Share Value: The value of VZD-Shares changes over time as the vault's strategies generate yield, affecting the DAI-to-share ratio.

Step 5: Handling Fees and Slippage

Fee Structure: VaultZ may have implemented a fee structure, where a small percentage of the withdrawn amount is deducted as a fee.

Slippage Considerations: When large amounts are deposited or withdrawn, slippage might occur, affecting the share price. The vault's smart contract accounts for this in its calculations.

Additional Features

EIP-2612 Implementation: To improve user experience, the vault may implement EIP-2612, allowing users to perform transactions without requiring a separate ERC-20 approve call, thereby saving gas costs.

Event Emission: For each deposit and withdrawal, events are emitted for transparency and to allow external observers and interfaces to track these actions.

EIP-2612 introduces a standardized method to add off-chain signing capabilities for ERC-20 token approvals. This proposal enhances the ERC-20 token standard by allowing users to approve token transfers using signatures instead of on-chain transactions. The primary component of EIP-2612 is the addition of a permit function to the ERC-20 token standard.

Key Components of EIP-2612

Permit Function: The core feature of EIP-2612 is the permit function. This function allows a token holder to give a spender permission to transfer a specified number of tokens on their behalf, using a signed message, rather than an on-chain transaction. This method is not only more gas-efficient but also user-friendly.

EIP-712 Standard: EIP-2612 leverages EIP-712, which standardizes secure, typed, and structured data hashing and signing for Ethereum. EIP-712 makes the signed messages more readable and safer for users, allowing them to understand exactly what they are signing.

Nonce: To prevent replay attacks, EIP-2612 introduces a nonce, a number that is unique to each operation and must be used once. The nonce ensures that each permit signature is unique and cannot be reused maliciously.

Deadline: The permit function includes a deadline parameter, specifying the time until when the signature is valid. This feature adds a layer of security by limiting the duration for which the signed approval is effective.

Implementing EIP-2612 alongside ERC-4626 in DeFi protocols, especially those involving yield-bearing vaults, offers several advantages.

Many ERC-4626 vaults implementations inherit approval mechanisms from standard ERC-20 contracts for depositing and redeeming shares. This means users first have to approve() the vault before calling deposit() else transfers will revert. Each new contract integration incurs added gas overhead through approval events.

Implementing EIP-2612 for vault share tokens saves gas by substituting this two-step pattern with single step permit signatures. Wallets can directly call deposit or redeem by passing signed permits giving the vault temporary access rather than separate writes for allowances. This improves efficiency and user experience around vault interactions across DeFi.

Additionally permits enable interesting smart contract interactions not possible with standard approvals today since those cannot originate directly from contracts themselves as only Externally Owned Accounts (EOAs) can actively sign transactions. With permits, a programmatic keeper bot could swap collateral yields to stablecoins when reaching defined thresholds for example.

In summary, EIP-2612 complements ERC-4626 by offering a gas-efficient, secure, and user-friendly method for token approvals, which is essential in the DeFi space where ERC-4626 is predominantly used. This combination enhances the overall efficiency and appeal of DeFi protocols, encouraging wider adoption and user participation.

Applications and Use Cases

Simplifying Development of Derivative Contracts and Linear Pools

The vault architecture prescribed by ERC-4626 aids construction of derivative financial products relying on an accurate price feed for the underlying asset. Consider tokenized staking - holders want exposure to yield and governance rights from protocols like Ethereum’s proof-of-stake chain without locking assets or relinquishing liquidity.

Protocols like Lido allow staking ETH while minting derivative tokens like stETH backed by the staked ETH. But tracking the precise exchange rate between staked derivatives and ETH is complex, with fluctuations in yield, slashings, mev extractors, and more. This hampers the pricing of options, futures, and other contracts settling to staked ETH.

However, wrapping Lido’s vault as an ERC-4626 compliant contract provides reliable exchange rate oracles. The standard explicitly requires the calculateShares() view function quoting precise rates between vault tokens and assets. This allows properly pricing options, futures, swaps and other structured products on stETH using a consistent interface.

The same applies to another class of derivative contract called linear pools allowing swapping staked derivatives like stETH directly for assets like ETH. Tracking the relative value between pairs is crucial for setting invariant exchange rates. Attempts like Curve’s base pool have relied on highly manipulated external pricing feeds. But implementing linear pools atop standards-compliant vaults use verifiably authentic on-chain data by design. This resistance to manipulation aids sustainable liquidity and pricing.

Linear pools are decentralized exchange pools with two key characteristics -

Fixed invariant asset ratios

Change in price/value of one asset directly impacts the other

(This contrasts with traditional constant product pools like Uniswap where price impact is logarithmic. Same input asset amount yields diminishing price impact)

For example, a DAI-USDC linear pool always ensures the value of 1 DAI = 1 USDC in the pool by programmatically rebalancing based on an oracle feed.

So if the external market price changes to $1.01 per DAI:

Pool becomes unbalanced with too little USDC vs extra value of DAI

To maintain ratio, pool automatically mints extra USDC and uses it buy back DAI

Brings levels back in sync to peg

This direct linear linkage between paired asset values and prices allows efficiently swapping between tokens with minimal slippage as rebalancing handles price fluctuations.

Now, Linear pools are ideal mechanisms for swapping staked token derivatives like Lido's stETH back to mainnet assets like ETH.

As yield coming from validators causes disparities between stETH and ETH price, linear pools automatically rebalance quantities to maintain parity. This provides liquidity and fixed conversion rates for stakers despite volatile returns.

For example, a stETH-ETH linear pool implemented using Yearn yVaults as an ERC-4626 compliant wrapper would feature:

Direct redemption of stETH for ETH using verifiable on-chain exchange rates

Pool rebalances as yield accumulates to ETH backing per stETH

Resistant to manipulation of external price feeds

Linear pools create efficient conversion between assets with reliable invariant pricing, particularly valuable for staking derivatives. ERC-4626 standardization further locks in these guarantees for developers and users leveraging vault interoperability.

Abstraction enables permissionless innovation without gatekeepers. Structured products on vault tokens no longer need approval by specific platforms. Anyone can build options on Lido stETH or futures on any vault without requiring bespoke integrations. Vault derivatives may unlock markets around niche yield generating strategies historically harder to financialize at scale.

Tokenized Staking Positions and Enhanced Composability

Using consistent interfaces for tokenized staking derivatives like stETH, sdBTC and mSOL enhances composability within DeFi’s money Lego architecture. Automatic yield optimizers like Yearn can reallocate capital across standardized vaults based on performance analytics rather than one-off integrations.

Traders can develop complex cross-chain arbitrage strategies on liquid staking derivatives leveraging vaults from Kava, Anchor, Kinetic, and more. Options platforms build products on diversified baskets of yield-generating vault tokens. Credit facilities accept tokenized staked assets from multiple chains as productive collateral assets given they share a common interface. Ultimately abstracting away implementation behind vault standards unlocks innovation potential.

Utilization in Lending Protocols and Yield Aggregators

Lending platforms and yield chasers can leverage ERC-4626 compliant vault tokens as collateral assets or yield optimization opportunities respectively. The standard intrinsically creates price and liquidity oxygen through broader financialization.

For lenders, accepting vault shares as collateral significantly expands the pool of productive cryptoassets available for borrowers on both the demand and supply side. Auditors certify standards-compliance, creating immediately collateral eligibility instead of one-off approvals. Borrowers access under collateralized leverage against sophisticated yield generating strategies they previously couldn’t replicate themselves.

In parallel, yield aggregators divert capital into maximized return opportunities across vaults exposed via a unified interface. Cross-platform capital allocation decisions simplify dramatically. Platforms conserve resources otherwise spent analyzing custom accounting schemes. The result - efficient yields for providers and enhanced leverage for borrowers.

Based on the nature of ERC-4626, we can anticipate or conceptualize different types of vaults that could be developed under this standard. Here are some more potential types, keeping in mind that actual examples might vary as the ecosystem grows:

Apart from the above-mentioned examples, we wanted to build on a few potential directions:

Composable Risk Tranches

Rather than singular investment mandates, we could see vaults structured to offer tiered exposure to the same underlying portfolio for varying investor profiles:

Senior Tranche - lower risk/return as a fixed income replacement

Mezzanine Tranche - moderate risk/return for balanced exposure

Junior Tranche - higher risk/return with equity-like upside

This applies the principles of securitization in traditional finance to customize decentralized offerings.

Integrative Fintech Applications

Vaults could serve as vehicles for blockchain integrations with mainstream fintech like Robinhood, Revolut or neobanks. These firms may utilize vault standards to offer cutting edge DeFi savings rates, staking yields and risk-managed crypto investments alongside their existing app functions.

Instant Settlement Centers

Vaults can provide pools of on-chain liquidity for prediction markets, online betting, and other applications requiring instant settlements, token swaps, or price discovery rather than relying solely on external oracles. The composability inherent to vault standards creates Lego-like potential to bridge fintech, traditional finance, and blockchain innovation - unlocking a new generation of embedded DeFi services.

Risks

At first glance, the emergence of standards like ERC-4626 may seem purely positive, ushering in greater composability and interoperability between the multiplying array of DeFi protocols we see today. However, as builders seeking to build sustainable long-term systems, we must go beyond surface level optimism to ask - what could go wrong?

You see, financial incentives have a funny way of exposing unexpected flaws in even the most well-intentioned designs once adoption reaches scale. And the alchemy of combining multiple protocols creates emergent behaviors that no single developer can entirely anticipate. Remember flash loan attacks vectoring stablecoin depegs? DeFi is complex!

So, while cross-platform vault standards eliminate tedious one-off integrations, we must acknowledge the flip side – standardized exploitation attack surfaces now span ecosystems rather than individual verticals. Not to mention that vault strategies attempt to maximize yield using inherently aggressive tactics like uncollateralized leverage from derivatives and liquid staking.

There is intrinsic risk in the quest for alpha. So standards or not, we must apply first principles to rigorously pressure test vaults under adversarial conditions. Assure safety for assets entrusted to them by users seeking principled yield. And learn to balance the incredulous power granted by abstraction with the in credulous responsibility to build economic security for the long haul.

Because while novel composability and permissionless innovation excite the pioneer in us, the duty we owe users looking to survive crypto winters compels more judicious reasoning.

Potential Security Pitfalls Under ERC-4626

Managing feeOnTransfer Tokens: Some tokens charge automatic fees when transferred by deducting a percentage from amounts. When interacting with these, vaults must ensure the correct net token amounts get deposited after fees while still minting expected user shares. Failing to account for fee calculations during deposits/withdrawals risks imbalanced accounting and loss of user funds.

Proper Use of Decimals: If the vault does not align to the same number of decimal places as the underlying token, loss in precision can occur through rounding errors during exchange rate conversions. Users may receive fewer shares on deposits or assets on withdrawals. Explicitly handling decimals parity with assets is crucial.

Rounding Considerations: Related to decimals, the direction of rounding in key calculations like calculateShares and calculateAssets can subtly favor the vault vs users. Consistent and documented rounding directions prevent unfair skewing over many micro calculations.

Preview Functions: Preview redeem returns maximum redeemable assets for shares, while preview mint shows minimum received shares for a deposit amount. Confusion between the two can lead to unintended loss of funds if assumptions are mixed up.

Overriding Core Functionality: Rather than overriding base deposit/withdraw methods, custom logic should use extensibility hooks provided. Core methods have complex logic to handle reentrancy, balance updates etc. Hooks avoid disrupting these protections.

The Zero Share Case: Special handling may be required in vault interactions with zero user shares. Standard behavior expectations should be defined around deposit/withdrawal reversals and fee transfers during this edge case.

Vaults as Price Oracles: Basing external contract pricing on potential manipulated exchange rates from calculateShares leaves contracts vulnerable similar to oracle attacks. Defensive coding assumes malicious rates.

Implementation-Specific Issues: Adhering to a standard interface does not guarantee individual implementation safety. Audits must review code thoroughly for issues like reentrancy, access controls and trust assumptions in the vault strategy and accounting logic.

EOA Slippage Allowances: If allowing EOAs direct access, the vault may accommodate slippage losses between previewed and actual exchange rates on withdrawals through caps or feathered limits.

Vault Extensions: While custom extensions improve flexibility, significant deviations from the standard in aspects like fee models, pricing logic and share minting conditions risk breaking integration assumptions and should be analyzed for soundness.

Many issues, like decimal handling, rounding principles, and preview logic, seem trivial in isolation. But they set cascading precedents down architectural stacks that propagate risk. It only takes one vault getting these micro decisions wrong early on for severe implications in integrated contracts built atop, now outside the vault developer's control.

We currently enjoy a builder-first environment focused on innovation velocity. But as trapped capital rises, professional attackers with short horizons will emerge seeking to extract value from network participants through technicalities made possible by complexity. We must design assuming their existence.

Standards like ERC-4626 gain rapid grassroots adoption, given savings in duplicated work. But formal processes ensuring integrity and safety lag this organic growth. We need clarity on certification for collateral token eligibility, audit practices, patch responsiveness, governance signaling, and liability transparency to parallel open-source composability with institutional-grade reliability.

In an increasingly multi-chain future, events like bridge hacks, cross-chain threats and national policies create unmodelled chaos risk. Institutional safeguards via governance, insurance and algorithms managing volatility become necessary to limit viral impacts across state channels. This spans beyond technical domains into social and political spheres as well.

Some of the well-known hacks

Rari Capital

The Rari Capital incident is often cited as a case study of the importance of secure smart contract design and the risks associated with cross-protocol interactions in DeFi.

Background

Rari Capital: A DeFi platform offering various yield-generating products.

Ethereum Pool: One of Rari Capital's products, which allowed users to deposit Ethereum (ETH) to earn yield.

The Incident

Date: The hack occurred in 2021.

Loss: Approximately $11 million worth of tokens, equating to 60% of the total funds in the Rari Capital Ethereum Pool.

Rari Capital offered yield generating products in Decentralized Finance (DeFi), including the Rari Ethereum Pool which allowed users to deposit Ethereum (ETH) and earn interest on their holdings.

Root Cause Analysis

The key technical factor that enabled this incident traces back to the integration between Rari's Ethereum Pool and Alpha Finance's ibETH (inverse bonded ETH) token contract.

As a yield-generating strategy, Rari's pool deposited users' ETH into ibETH issued by Alpha Finance. To track the value of ETH holdings and user shares, Rari smart contracts referenced two key functions from ibETH - totalETH() and totalSupply().

However, the ibETH contract contained a function called work() that was unexpectedly exploitable. It allowed arbitrary contract calls to be invoked while also being a payable function that could alter the total ETH balance tracked within ibETH's accounting.

By repeatedly calling Rari's deposit and withdraw mechanisms and manipulating total ETH amounts reported by ibETH in between, the attacker was able to redeem more funds than entitled based on inflated ETH pool values.

This presents a valuable case study on the risks of unconstrained cross-protocol integrations in DeFi without security reviews. It also underscored gaps around reentrancy protections with state changes between interacting contracts.

Lessons Learned

Cross-Protocol Risks: The incident highlighted the risks associated with integrating multiple protocols, especially when one protocol's functions can influence another's financial calculations.

Smart Contract Security: The need for thorough auditing and understanding of smart contract interactions, especially in complex DeFi ecosystems.

Reentrancy Attacks: The importance of guarding against reentrancy attacks, a common vulnerability in smart contracts.

In response to the incident, Rari Capital boosted security processes including audits of external protocol connections to safeguard future integrations.

At the ecosystem level, this catalyzed growing emphasis on the need for consistency - where standards like ERC-4626 emerge to enable secure, aligned interaction assumptions for interoperable DeFi contracts. Formalizing interfaces reduces chances of unvetted state manipulation across pooled liquidity and underlying yield vaults.

Cream Finance

The Cream Finance incident is often cited as a case study in the complexities and risks inherent in DeFi systems, particularly concerning the use of oracles and token supply mechanisms.

Background

Cream Finance: A DeFi platform offering lending and exchange services.

Date of Incident: The attack occurred in 2021.

Financial Impact: The exploit led to a substantial financial loss of ~$130M

Cream Finance offered an array of decentralized lending and exchange services in the DeFi ecosystem. Users could supply assets, take loans or swap tokens using various integrated protocols.

The technical root cause was the manipulation of price oracles and uncapped minting functionality of certain tokens. The exploit involved two key weaknesses -

Cream’s yUSD vault used a manipulable funding rate oracle based on external DeFi protocol rates like Yearn and Curve. By pumping specific tokens, attackers influenced this oracle.

Cream had not capped supply for some of its ERC-20 tokens. Attackers minted a large number of these tokens artificially.

By sending a large amount of yCRV tokens into the yUSD vault, the attackers were able to alter the apparent yUSD exchange rate and inflate its perceived dollar value. With the compromised oracle rates, the attackers then borrowed heavily against their freely minted ERC-20 tokens, which now seemed to surpass collateral requirements. They then withdrew their borrowed assets, draining Cream's liquidity without adequate backing.

Lessons Learned

Oracle Security: The critical role of secure and reliable oracles in DeFi platforms. Oracles are external services that provide price feeds for assets, and their manipulation can lead to significant vulnerabilities.

Token Supply Management: The risks associated with uncapped token supplies and the importance of proper tokenomics in DeFi.

Complexity of DeFi Systems: The incident highlighted the complexities involved in DeFi platforms, especially when integrating multiple protocols and financial instruments.

In the aftermath, Cream implemented measures like capping all token supplies, using chainlink oracles, and validating vault rates on-chain to restore integrity. The exploit revealed overlooked risks in DeFi architecture - manipulation of external data feeds and unchecked token issuance. It reinforced the need for formal verification of inputs immutable policies and reviewed protocol integrations to assure reliability at scale.

These incidents exposed systemic gaps not addressable purely through engineering.

These incidents revealed that despite claims of decentralization, DeFi still has points of centralization creating bottlenecks. The concentration of control manifests through factors like

key infrastructure reliance (oracles),

privileged roles (governance), and

financialization incentives.

Standards partly address this, but true antifragility requires distribution evolution.

However, the space is evolving faster than security best practices can disseminate. Each new innovation expands the attack surface exponentially as combinatorial complexity compounds. Formal verification cannot keep pace with emergent behavior at scale. Though standards help, balancing creativity and constraints remains an art.

Also, the builder-first ecosystem optimizes innovation velocity over sustainability. But as capital concentration increases, adversarial incentives manifest. Commercial exploit potential will attract state-level resources over time. Alignment to protect users requires economic security to match technical security - assurance funds, coordinated governance, and mitigation plans.

Conclusion

And there you have it - a comprehensive tour of ERC-4626 and the emerging realm of interoperable tokenized vaults. We've covered a lot of ground here on the motivation, functionality, architecture, applications, and risks associated with this promising standard.

As you can see, while vault abstraction promises immense composability, we must remain vigilant. The incidents reveal systemic gaps in realizing the decentralized vision that standards alone can't address. We need assurance mechanisms and governance evolution to match the pace of innovation.

Yet the pace of experimentation also creates progress - each breach leads to incremental improvements inoculating ecosystems over time as lessons disseminate. The diverse vault use cases we discussed highlight the latent potential in this design space between financial lego primitives.

So, where do we go from here?

For builders, it's about responsibility - understand dangers, advertise risks, and fix issues pre-emptively.

For users, it's about self-education - don't blindly chase yield; scrutinize your exposures.

For regulators, it's about nuance - don't paint all "DeFi" with the same brush; differentiate between regulating judiciously.

The opportunities for participation are endless, as are the possibilities for value creation with aligned incentives.

Find L2IV at l2iterative.com and on Twitter @l2iterative

Author: Arhat Bhagwatkar, Research Analyst, L2IV (@0xArhat)

References

Disclaimer: This content is provided for informational purposes only and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisors as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services.